Non-Discretionary

Investment Consulting

- We provide recommendations for your policy and portfolio.

- Your investment committee reviews and approves our recommendations.

- Your staff manages trade executions and cashflow with our support.

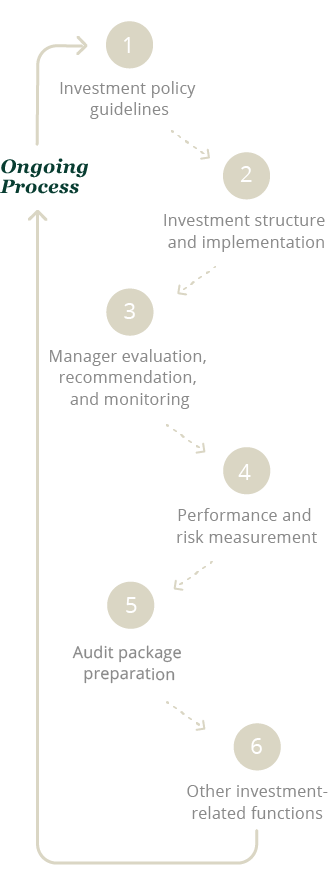

Prime Buchholz is more than an investment advisor. Our sophisticated research operation is a powerhouse that is flexible enough to meet your unique needs and function as an extension of your staff. As a fully integrated partner, we help lighten the burden on your internal staff by providing structure and resources that help them make effective decisions. Our back-office team handles all coordination of investment activity, giving you the time to focus on your goals.

Our non-discretionary Investment Consulting service offers significant operational support, expert guidance, and strategic insights that are tailored to align with your specific financial goals and risk tolerance. We work closely with you to develop a strategic investment approach, providing insights on market trends, asset allocation, and manager selection.

While you maintain full control over your investment decisions, our portfolio guidance, operational support, and in-depth portfolio analytics and reporting help ensure your portfolio remains aligned with your long-term investment objectives.

Our non-discretionary Implemented service is a hybrid of our OCIO and Investment Consulting services. This service arrangement allows you to maintain control over investment decisions while outsourcing tasks associated with portfolio execution—reducing the administrative burden on your organization’s staff.

The hybrid approach adapts to our clients’ unique needs, offering expert non-discretionary guidance, strategic insights, and outsourced portfolio execution, while allowing you to maintain final decision-making authority over portfolio decisions.

Our discretionary Outsourced Chief Investment Officer (OCIO) service offers comprehensive portfolio management tailored to meet your organization’s unique goals and requirements. We manage day-to-day investment activities, including management of the portfolio, trade execution, and cash management, allowing you to focus on your core mission.

Our OCIO approach is designed to align with your financial objectives and risk tolerance, helping to ensure proactive and strategic asset management. Clients benefit from our portfolio management expertise and comprehensive operational support, to provide a fully outsourced solution covering both portfolio decision-making and portfolio execution.

Please review our Investment Perspective, Unraveling OCIO Solutions: A Guide for Investors, for more information.

PrimePlus was created by investment experts here at Prime Buchholz to elevate the investing and portfolio management experience for our clients. By aggregating data from multiple sources and streamlining analytics, PrimePlus provides clarity and meaningful insights in just a few clicks – whenever and wherever you need them.

Learn MoreSustainable, responsible, impact investing–let us be your experienced navigator. We've been helping organizations align their investments with their missions and values for three decades.

Learn MoreWe're a trusted, go-to resource for plan sponsors as they seek to maximize their plan benefits and meet their fiduciary responsibilities with confidence.

Learn MoreDiagnostic Review

Comprehensive assessment of client’s

portfolio and full financial picture