Carol O'Neale

Principal/Consultant

Being a Black woman in finance means I have been the “first” for many organizations. I was the first Black woman to serve as controller for the Diocese of New York and later as a consultant at Prime Buchholz, headquartered in one of the least diverse states in the country. Taking these roles required a leap of faith, as concerns about tokenism were real, and the efforts of the industry to be more diverse are well documented. But my experience at Prime Buchholz has been different. The Firm’s transparency and commitment to diversity, equity, and inclusion (DEI)—both within the organization and in its manager due diligence—has made me feel genuinely valued.

In the wake of the unrest that followed the murder of George Floyd in 2020, there was a dramatic increase in opportunities around diverse investing. Large investment funds sought diverse limited partners, others directed funds to support diverse individuals, and it seemed Corporate America was appointing chief diversity officers every other day.

However, since then, there has been a rise in anti-DEI sentiment and legislation. Over time, the intensity of public discourse and the momentum for systemic change has waned. While some progress has been made, there is a noticeable shift back to complacency and even regression. Some of the largest colleges and universities in the country have cut back or eliminated DEI programs, while affirmative action was reversed by the U.S. Supreme Court in 2023. More recently, the U.S. Court of Appeals for the 11th Circuit blocked the Black-owned venture capitalist firm Fearless Funds from awarding grants exclusively to black women entrepreneurs.

This backlash against diversity initiatives has demonized DEI as antithetical to merit and an obstacle to investment performance—despite evidence showing this misconception is unfounded. In fact, numerous studies have shown diversity can enhance performance.

This investment perspective will delve into the state of diversity in the investment industry, provide data related to performance, and address some of the challenges going forward.

The State of the Industry

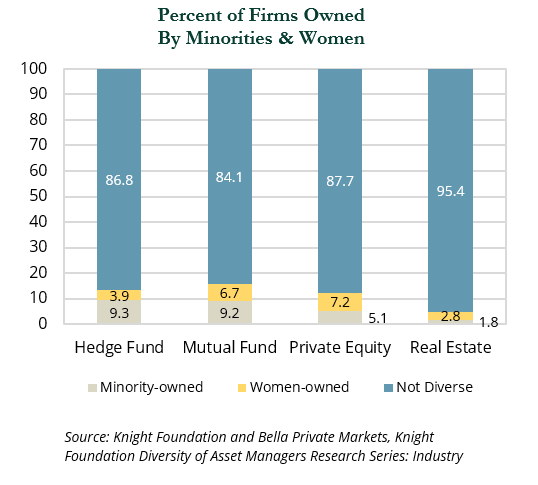

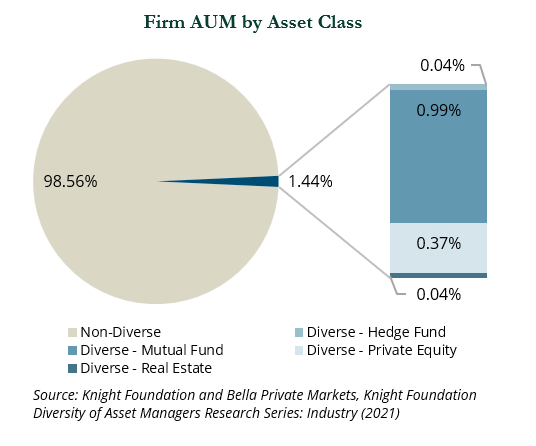

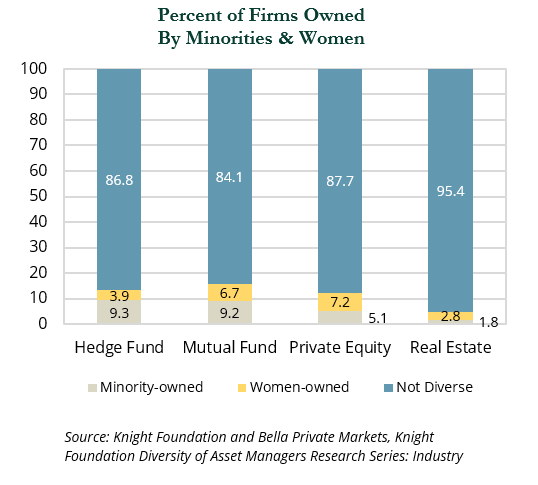

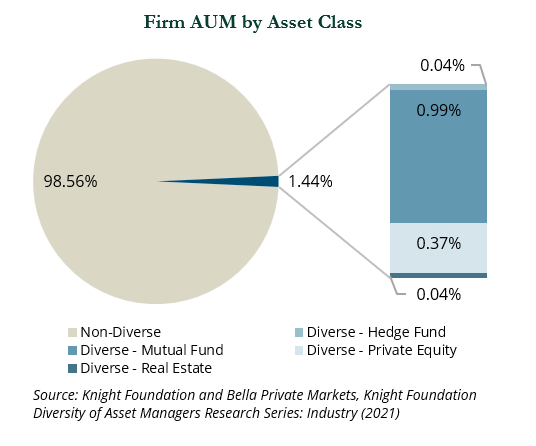

The asset management industry has long been characterized by a lack of diversity, with its leadership and workforce predominantly composed of White men. The foundational study of the Knight Foundation Asset Managers Research Series in 2017[1] revealed that women and minorities managed roughly 1% of assets under management in the United States. A follow-up study[2] four years later showed a slight increase in diverse representation, but the overall number remained below 2%.

Those same studies looked at the performance of diverse managers (by gender and race) and each concluded performance was as good—in some cases better—than non-diverse managers. However, total investment has been slow to grow.

Subsequent studies by other organizations have affirmed that conclusion. McKinsey & Company’s 2023 Diversity Matters report concluded companies with diverse leadership teams are associated with higher financial returns.

Despite minorities representing a small fraction of the total assets under management (AUM), the number of diverse firms in the industry is disproportionately higher. This highlights the significant underrepresentation of minority-owned firms in terms of AUM, indicating systemic challenges in accessing larger investment opportunities.

Diverse Does Not Mean “Less Than”

As logic would suggest, a person’s race or gender does not impact their ability to invest. Therefore, it is not surprising that numerous studies have concluded that selecting diverse managers does not detract from performance.

- A 2022 meta-analysis of 56 studies spanning 50 years of data from the CFA Institute concluded diverse managers perform as well as non-diverse managers.[3]

- A 2023 McKinsey study found that firms in the top quartile for both gender and ethnic diversity are 39% more likely to achieve better financial performance compared to those in the bottom quartile.[4]

- A 2023 study[5] by Willis Towers Watson collected diversity data for over 1,500 investment strategies and compared their 5-year performance records. Investment teams in the top quartile for gender diversity outperformed those in the bottom quartile by 45 bps per year.

Our analyses of diverse managers have yielded similar results, concluding that investing in diverse managers does not require investors to sacrifice performance. Our performance review of more than 1,000 U.S. equity managers that reported diversity data revealed that products with over 25% diverse ownership had higher five-year alpha (as of March 31, 2024) than those below the 25% threshold.

Numerous data sources have consistently demonstrated that incorporating diversity into portfolio management not only maintains returns, but can potentially enhance overall financial performance and risk-adjusted outcomes.

Gaining Access to Diverse Firms

Institutional-quality diverse investment managers are becoming more accessible each year. Broad DEI efforts across the industry and global economy have brightened the spotlight on both established and emerging diverse managers. As a person of color, the elevated presence of these firms at conferences and industry events has been noteworthy.

There are many indicators that investment in diverse managers is growing rapidly. The 2023 NACUBO-Commonfund Study of Endowments[6] showed the percentage of endowments invested with diverse managers more than doubled—7.3% to 19.4%—from June 2022 to June 2023.

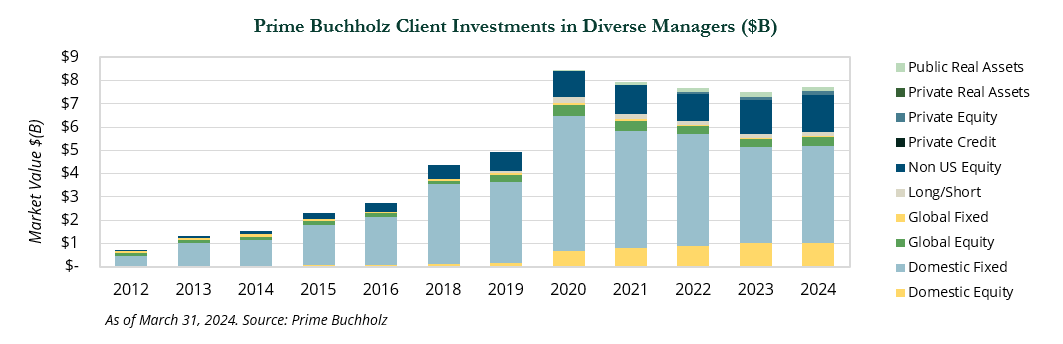

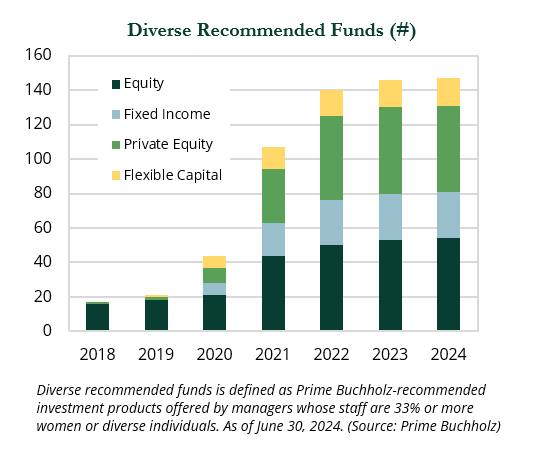

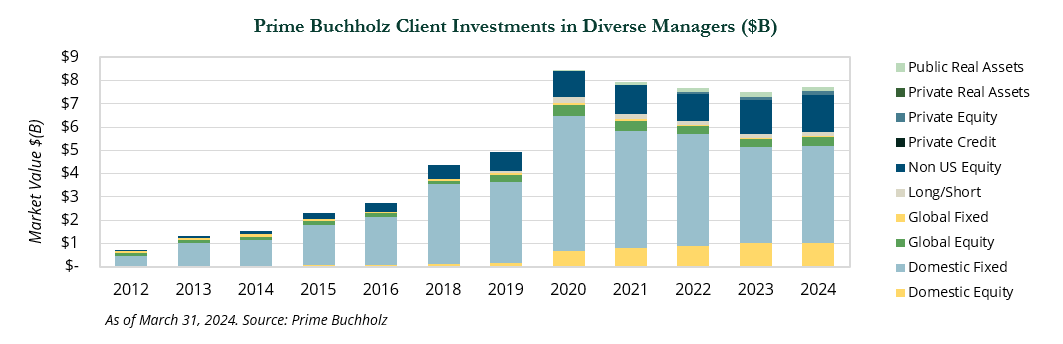

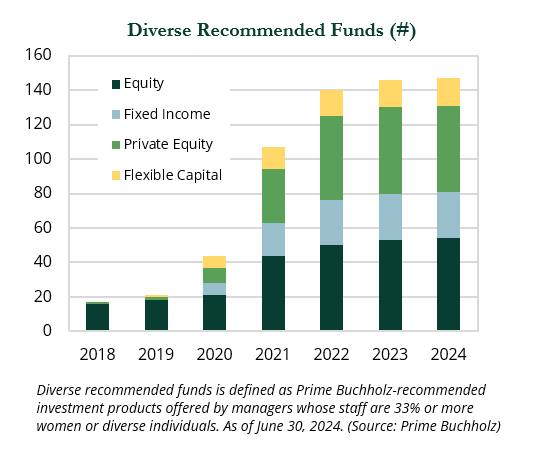

At Prime Buchholz, we responded to client interest by identifying and conducting due diligence on additional diverse managers as we sought to expand the opportunity set on our recommended manager list across asset classes. The efforts have been effective and resulted in a rapid increase in diverse manager investment while helping clients achieve their DEI goals.

Investing in Diverse Firms

To effectively integrate diversity into a portfolio, institutional clients must eschew the belief that diversity leads to lower returns. Often, this corresponds with other efforts to promote diversity in an organization, either through specific initiatives or new hires/promotions. Engaging with key stakeholders is crucial for fostering ongoing conversations, addressing concerns, and discussing steps to move forward.

Know What You Own

On an annual basis, we distribute a comprehensive survey of our recommended managers to help us understand, document, and evaluate their approaches to DEI. This is designed to offer our staff and clients the insight necessary to make critical portfolio decisions. We store this information in our proprietary online performance platform and client portal, PrimePlus®, so clients can access real-time portfolio information and analytical tools.

Bring Everyone to the Table

Engaging with staff, boards, family members, trustees, committees, donors, and/or community members to gather information can help level-set the conversation from the outset and gain commonality in definitions and materiality. Our online stakeholder survey is designed to help clients reach consensus and frame issues to facilitate productive conversation and create an action plan.

Find Like-Minded Partners

As the investment landscape continues to evolve, we strive to support our clients by leveraging resources from various organizations, partners, and clients who are dedicated to expanding opportunities for diverse managers and communities.

Align Your Portfolio

Clients with a mission-aligned investment approach can both leverage their spending to advance their mission and invest the remaining corpus with managers who prioritize diversity. Prime Buchholz engages with managers from the beginning of our due diligence process and regularly monitors developments to assess their commitment to DEI. We maintain a vetted list of investment managers with diverse ownership, management, and teams.

Make an Action Plan … and Act

With input from stakeholders and guidance from your IPS, we work with clients to enhance diversity across the portfolio’s investments. Our portfolio exposure reports provide detailed information on ownership, management, and decision-making, as well as qualitative insights on each firm’s and investment strategy’s initiatives to promote DEI.

Conclusion

My journey as a Black woman in finance has been both challenging and rewarding. Joining Prime Buchholz as a consultant and gaining access to the analytical tools and deep knowledge of my colleagues has allowed me to work with inspiring clients who seek to improve the world through execution of their missions. I have also appreciated the opportunity to share my perspective as both a person of color and as one of the many exceptional women that lead at Prime Buchholz.

The investment industry’s progress on diversity has faced some setbacks, but I believe it is crucial to continue to advocate for representation and alleviate concerns through open conversations. Sharing information and ideas will be essential in fostering a more inclusive environment going forward.

Aligning client portfolios to their missions is one of our greatest strengths, and we stand at the ready to help turn discussion into action.

Please reach out to your investment team with any questions. ⬛

[1] Knight Foundation and Bella Private Markets, Diversifying Investments: A Study of Ownership Diversity and Performance in the Asset Management Industry,” (2017) [2] Knight Foundation and Bella Private Markets, Knight Foundation Diversity of Asset Managers Research Series: Industry (2021) [3] CFA Institute/Theresa Hamacher, Diversity and Investment Performance: What Trade-Off? (2022) [4] McKinsey & Company, Diversity Wins: How Inclusion Matters (2023) [5] Willis Towers Watson, Diversity in the Asset Management Industry, (2023) [6] NACUBO, The 2023 NACUBO-Commonfund Study of Endowments (2024) Indices referenced are unmanaged and cannot be invested in directly. Index returns do not reflect any investment management fees or transaction expenses. All commentary contained within is the opinion of Prime Buchholz and is intended for informational purposes only; it does not constitute an offer, nor does it invite anyone to make an offer, to buy or sell securities. The content of this report is current as of the date indicated and is subject to change without notice. It does not take into account the specific investment objectives, financial situations, or needs of individual or institutional investors. Information obtained from third-party sources is believed to be reliable; however, the accuracy of the data is not guaranteed and may not have been independently verified. Performance returns are provided by third-party data sources. Past performance is not an indication of future results. © 2024 Prime Buchholz LLC