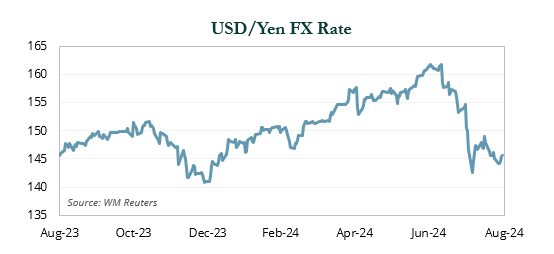

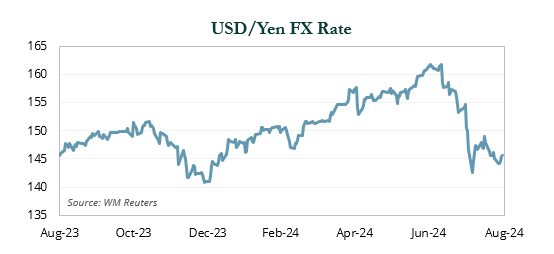

The start of August was bookended by a rate hike by the Bank of Japan on July 31st and a surprisingly weak nonfarm payroll report on August 2nd. Japanese equities sharply declined when the Nikkei re-opened on August 5th and the Japanese yen rallied as the carry trade was unwound. Volatility spiked across the globe and U.S. equity markets were weak during the first full week of the month.

Markets calmed, and by the end of the month, equities delivered positive performance. However, growth concerns remained and rates moved lower following Fed Chair Jerome Powell’s dovish remarks at the Jackson Hole Symposium. This led to positive performance from fixed income and interest rate-sensitive sectors like real estate. However, global growth concerns did put downward pressure on energy investments.

Global Equities

Domestic equity markets continued their run, registering a fourth consecutive month of gains and nine out of 10 months of positive performance.

The S&P 500 returned 2.4%, while the broader Russell 3000 Index advanced 2.2%. Large and mid cap stocks led the market, with the Russell 1000 Index gaining 2.4%. After a very strong July, small cap stocks pulled back, with the Russell 2000 Index posting a 1.5% drawdown. Value stocks modestly outperformed their growth counterparts, with the Russell 3000 Value Index gaining 2.4% vs. 1.9% for Russell 3000 Growth.

In a reversal from July, where the market environment was risk-on, defensive sectors led the way in August. Consumer staples (+5.5%) was the best performing sector, followed closely by real estate (+5.3%) and utilities (+4.4%). Healthcare (+4.9%) was another standout, lifted by strong earnings from drug maker Eli Lilly (+19.5%). Commodity-oriented segments lagged for the month, with energy (−2.4%) finishing as the worst performing sector. Consumer discretionary (−0.8%) was the only other sector to post a drawdown, dragged down by blue chips Amazon (−4.5%) and Tesla (−7.7%).

The volatility in the U.S. that started the month bled overseas. Once the dust settled, however, both developed non-U.S. (+3.3%) and emerging markets (+1.6%) ended August in positive territory. Japan garnered global attention, with investors spooked over U.S. economic data and the yen carry trade unwinding following the Bank of Japan (BoJ) rate hike. The Nikkei 225 fell 12.4% on August 5th, its worst day since 1987; the Nikkei would briefly enter a bear market, down over 20% from the record high one month prior.

As August progressed, the yen stabilized and the Nikkei recovered, finishing August down just 1.1%. When factoring in currency movements, U.S.-based investors experienced a positive return (+0.5%) from Japan. With Japan edging out a gain, all developed countries registered a positive return in USD terms.

Emerging markets were muted relative to their developed counterparts. Performance dispersion by country was wide. China (+1.0%) continued to grind along slowly. While Beijing’s efforts to boost growth have led to pockets of improvement, particularly in manufacturing, the country’s economic outlook remains weaker than expected.

Brazil (+6.7%) was among the top performing countries, benefiting from stronger than expected GDP growth. Taiwan (+3.4%) continued its surge on the back of strong chip demand but pulled back toward month-end after another quarter of strong earnings from NVIDIA raised questions around the company’s pace of growth. This change in sentiment dragged Asian chipmakers broadly and pushed South Korea (−2.2%) into negative territory. Elsewhere, political uncertainty weighed on Mexico (-5.3%) where President Andres Manuel Lopez Obrador is threatening to make radical changes to the constitution before he leaves office on October 1st.

Fixed Income

August began in dramatic fashion as risk assets sold off and the VIX soared in response to a weaker than expected July jobs report. On a positive note, fixed income served as a safe haven. Yields rallied sharply across the curve, as traders doubled down on September rate cut expectations. Yields stabilized in the weeks that followed, and the attention eventually shifted to Fed Chair Powell’s Jackson Hole speech for clues on monetary policy. While the speech provided little clarity on the magnitude or pace of cuts, it all but solidified a September cut, sparking another big rally in yields during the month.

The yield curve underwent a bullish steepening in August. The 2-year yield fell by 34 bps and the 10-year yield declined 13 bps, which caused the 2s10s spread to steepen from −21 bps to −1 bps. Consequently, as yields fell, long duration fixed income securities outperformed. Conversely, shorter duration fixed income securities lagged. Long Treasuries gained 2% during the month, whereas 5-10 year treasuries and 1-3 year treasuries returned 1.3% and 0.9%, respectively.

Spreads followed a different trajectory, initially widening in response to the soft jobs report before narrowing by month-end. Overall, spreads for most sectors remained relatively unchanged month-over-month. However, high-yield bond spreads were notably tighter by 9 bps. This contributed to a 1.6% return for the sector, which was on par with the return for investment grade corporates. This return was exceeded by a few fixed income sectors, including mortgage-backed securities, which returned 1.7%, and global bonds, the best performing fixed income sector. Currency dynamics, particularly the U.S. dollar’s decline was a key contributor to outperformance. The Global Aggregate Index returned a robust 2.4%, outpacing the return on the Bloomberg U.S. Aggregate Index by a full percentage point.

Real Assets

Real asset returns were mixed, with several sectors seeing gains on expected near-term rate cuts, while most energy-related sectors experienced losses. Global REITs were up 6.3% (12.7% quarter-to-date) with Asia REITs outperforming (+6.7%) as expectations for a September rate cut appeared all but assured. U.S. REITs gained 6.4%, led by the self-storage (+13.3%) and apartment (+10.4%) sectors, while industrial (+1.1%) and lodging/resorts (+0.8%) underperformed.

Global infrastructure gained 4.6% on rate cut expectations while returns were more muted within global clean energy (+1.3%), as manufacturers contend with lower sales prices in an effort to maintain market share.

Brent crude was down 4.8%, largely on market expectations that OPEC+ will begin to unwind its voluntary production cuts in the coming months. Coupled with strong U.S. production and decreasing sentiment around future oil demand, this caused concern that the market will be oversupplied in 2025. Natural resource equities shed 1.1% on lower oil prices.

Natural gas was up 9.5%, but was still bearishly priced at $2.1 MMBtu—at this level, any price movements are magnified percentage-wise. The outlook for the natural gas industry remains weak due to high storage levels, strong production, and expectations for a mild winter.

Gold (+2.8%) had another strong month amidst a backdrop of geopolitical uncertainty, strong central bank buying, and impending rate cuts, which would reduce the opportunity cost of holding the commodity. Gold finished August up 20.9% YTD, outpacing other real asset categories as well as the broader equity markets. Commodities were flat in August, with industrial metals (+3.4%) and precious metals (+1.9%) countering the pullback within the energy subindex (-4.3%). ⬛

Indices referenced are unmanaged and cannot be invested in directly. Index returns do not reflect any investment management fees or transaction expenses. Copyright MSCI 2024. Unpublished. All Rights Reserved. This information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. This information is provided on an “as is” basis and the user of this information assumes the entire risk of any use it may make or permit to be made of this information. Neither MSCI, any of its affiliates or any other person involved in or related to compiling, computing or creating this information makes any express or implied warranties or representations with respect to such information or the results to be obtained by the use thereof, and MSCI, its affiliates and each such other person hereby expressly disclaim all warranties (including, without limitation, all warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any other person involved in or related to compiling, computing or creating this information have any liability for any direct, indirect, special, incidental, punitive, consequential or any other damages (including, without limitation, lost profits) even if notified of, or if it might otherwise have anticipated, the possibility of such damages. Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material, or guarantee the accuracy or completeness of any information herein, or make any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, it shall not have any liability or responsibility for injury or damages arising in connection therewith. Copyright ©2024, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact. FTSE International Limited (“FTSE”) © FTSE 2023. FTSE® is a trade mark of the London Stock Exchange Group companies and is used by FTSE under license. All rights in the FTSE indices and / or FTSE ratings vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and / or FTSE ratings or underlying data. No further distribution of FTSE Data is permitted without FTSE’s express written consent. Indices referenced are unmanaged and cannot be invested in directly. All commentary contained within is the opinion of Prime Buchholz and is intended for informational purposes only; it does not constitute an offer, nor does it invite anyone to make an offer, to buy or sell securities. The content of this report is current as of the date indicated and is subject to change without notice. It does not take into account the specific investment objectives, financial situations, or needs of individual or institutional investors. Some statements in this report that are not historical facts are forward-looking statements based on current expectations of future events and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Information obtained from third-party sources is believed to be reliable; however, the accuracy of the data is not guaranteed and may not have been independently verified. Performance returns are provided by third-party data sources. Past performance is not an indication of future results. Copyright Prime Buchholz 2024.