Education, Perspectives

Bitcoin Milestones: Implications & Impact on Institutional Adoption

Jul 11, 2024

Back to all posts.Implications of Spot Bitcoin ETF Approvals

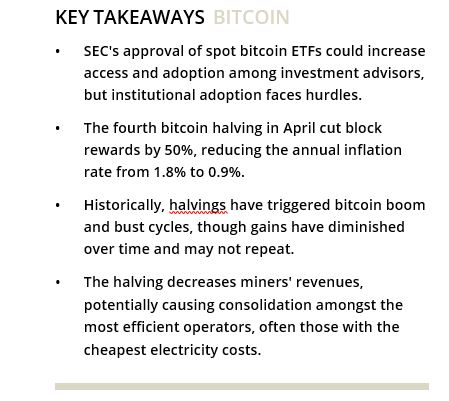

In January, the SEC approved 11 spot bitcoin ETF products, including products from notable investment management firms such as Blackrock, Fidelity, Invesco, and Van Eck. The new ETF products saw over $12 billion in net inflows during the first quarter, with Blackrock’s iShares Bitcoin Trust eclipsing $10 billion in value—the first ETF to reach that milestone so quickly. Strong inflows bolstered the price of bitcoin, which rose 51% year-to-date (YTD) through April 19, 2024.

Compared to the futures-based bitcoin ETFs, the new products have significantly lower fees and more efficient exposure to the price of bitcoin by directly holding the underlying asset. Futures-based products also have typically exhibited greater tracking error due to the costs and complexities associated with the rolling of futures contracts.

Further, the new products offer simple access via brokerage accounts, as well as tax and reporting efficiencies.

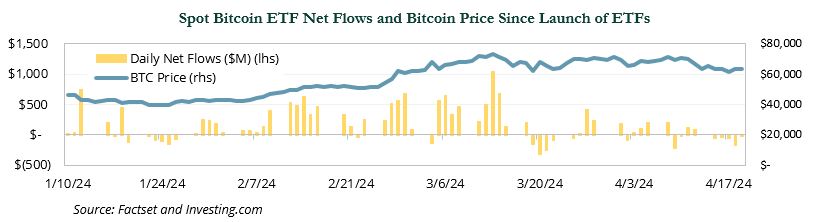

13F filings and an NYDIG analysis indicate that non-filers, likely retail investors, made up the overwhelming majority of owners of the spot bitcoin ETFs at 80.7%, as of March 31, 2024. This level of ownership is significantly higher than for other ETFs (43.5% for SPY and 61.8% for QQQ). Identified institutional ownership appears to be limited, led by hedge funds (8.0%) and investment advisors (6.4%). However, there was a notable investment by the State of Wisconsin Investment Board, which was valued at $163 million as of March 31, 2024.

Early inflows by investment advisors are noteworthy, as the acceptance of the bitcoin spot ETF products by advisors could potentially result in material asset flows, as there were more than 15,000 registered investment advisors managing $128.8 trillion at year-end 2023[1].

However, to date, major financial services firms have demonstrated mixed acceptance of the ETF launches. Raymond James Financial and Vanguard have blocked access to the products, with the latter explicitly stating it does not intend to offer the ETFs on its brokerage platform. Other firms (e.g., Morgan Stanley, Merrill Lynch, Wells Fargo) have only allowed unsolicited purchases of the spot bitcoin ETFs—in some cases, only for certain customers[2].

A recent survey of 437 financial advisors[3] regarding attitudes toward crypto assets was inconclusive. The survey results showed that 81% of advisors were either unable to buy crypto in client accounts—or were unsure whether they could before the launch of the ETFs—and 88% of advisors expressed interest in purchasing bitcoin but were waiting until it was approved. The survey also noted several critical roadblocks to broad acceptance, including regulatory concerns (64% of respondents), volatility (47%), and valuation difficulty (42%).

From a regulatory standpoint, the spot bitcoin ETF approvals should not be mistaken for regulatory acceptance of crypto assets, SEC Chair Gensler noted the approvals came in response to the District of Columbia U.S. Court of Appeals ruling that found the SEC had failed to adequately explain its disapproval of Grayscale’s spot bitcoin ETP and that “it should in no way signal the Commission’s willingness to approve listing standards for crypto asset securities.”

The Fourth Bitcoin Halving

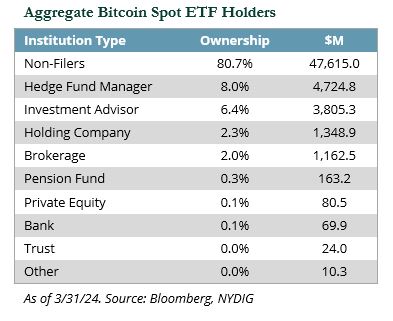

The fourth bitcoin (BTC) halving occurred on April 19th at block 840,000. The halving is a preprogrammed 50% reduction in the issuance rate of new bitcoin, with the new issuance decreasing from 6.25 BTC per block to 3.125 BTC per block. This is effectively a 50% reduction in the annual BTC inflation rate, from approximately 1.8% to 0.9%—a reduction in daily issuance from 900 to 450.

Halvings are programmed to occur after every 210,000 mined blocks (roughly every four years). Currently, there are approximately 19.7 million BTC in circulation, including lost bitcoin. In total, the supply of bitcoin is predetermined and fixed at roughly 21 million.

The periodic halvings were written into bitcoin’s algorithm as a foundation of its finite supply to confer value—a key economic feature. In theory, the reduction in the supply of an asset with consistent demand would result in a price increase. The block rewards provide an incentive to bitcoin miners to produce blocks, which store transaction data and keep the network secure.

Implications for Bitcoin Miners

Miners play a key role in verifying transactions and securing the integrity of the network. They perform energy-intensive computational work to validate transactions and ensure the network’s continuous operation. To incentivize their efforts, miners have the opportunity to earn BTC upon completing their tasks. The block rewards are currently the primary source of revenue for miners. Without an increase in the bitcoin price, halvings represent an immediate drop in miner revenues and profitability.

As the issuance from block rewards decline further, it is anticipated that transaction fees will become a greater share of miner revenues. The final block is expected to be mined in 2140, at which point transaction fees will be the sole source of revenue.

Transaction fees can incentivize a transaction’s inclusion in a block and are determined by supply and demand. They are generated either during periods of high transaction volumes or for other uses of the network. According to NYDIG, transaction fees have accounted for just 1.5% of miner revenue since inception. However, this is increasing. The recent introduction of ordinals and blockchain inscriptions increased transaction fees’ contribution to miner revenue to 5% as of March 2024.[4]

The computational complexity required to mine a block creates competition amongst miners to generate the most computing power. Miner profitability is therefore predominantly dependent on the computing power generated by hardware and the associated energy costs of powering those machines. Energy costs typically account for 75–85% of a miner’s total cash operating expenses.[5]

Therefore, the reduced BTC rewards post-halving could result in some mining companies failing to cover their costs. Miners with older, less efficient hardware or higher energy costs might be forced out of business, potentially resulting in the consolidation of mining power amongst the most efficient operators. Consequently, bitcoin miners are increasingly incentivized to find the cheapest source of electricity to power their operations.

While bitcoin’s significant energy consumption has been subject to criticism, the hunt for cheap energy could potentially be a catalyst to help make more renewable projects economically viable in locations where the energy demand market is not large enough to support utility-scale projects.

According to a 2023 KPMG report[6], bitcoin consumes approximately 110 terawatt hours of energy per year—roughly 0.55% of global electricity usage. The report suggests the incentive for less expensive energy sources could lead to greater integration of renewable energy, as the cheapest electricity is often tied to underutilized renewable sources or the use of waste gas that would otherwise be burned off (e.g., natural gas flares). Consequently, bitcoin mining powered by renewables increased from roughly 35% in January 2021 to 55% in January 2024[7].

Historical Returns Following Halvings

While past performance is not indicative of future results is an important caveat to heed when evaluating prior results, it is even more important to emphasize for investors when considering bitcoin performance. Bitcoin is a speculative emerging digital asset and there is no guarantee that its historical trajectory will persist. There also continues to be much debate in the investment community as to bitcoin’s value, purpose, and suitability in an investment portfolio.

prior results, it is even more important to emphasize for investors when considering bitcoin performance. Bitcoin is a speculative emerging digital asset and there is no guarantee that its historical trajectory will persist. There also continues to be much debate in the investment community as to bitcoin’s value, purpose, and suitability in an investment portfolio.

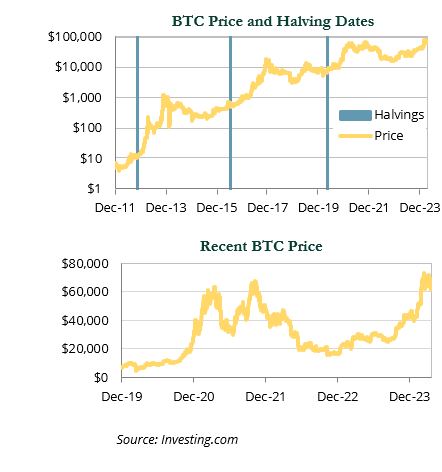

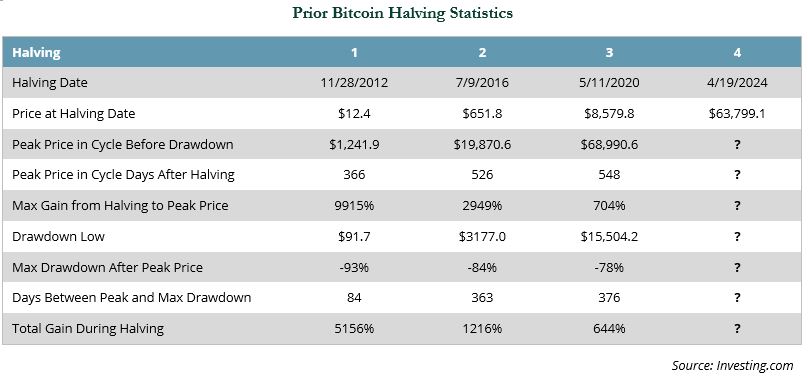

Historically, bitcoin has displayed a similar boom and bust pattern in the wake of halvings. In prior cycles, the price rose over 700%, peaking in price between 366 days (first halving) and 548 days (third halving) before experiencing significant drawdowns of 78–93%.

The price of bitcoin has experienced diminishing returns over time, as its market capitalization has increased—it rose 644% between the third and fourth halvings, compared to prior gains of 1,216% and 5,156% in prior cycles. However, the bitcoin price has, somewhat uncharacteristically, increased 51%.

On March 14, 2024, prior to the fourth halving—bitcoin reached an all-time high of $73,741, in part benefiting from strong flows from the recently approved bitcoin ETF products.

Looking Ahead: What’s Next in Crypto?

The spot bitcoin ETF products have the potential to spark broader bitcoin adoption by investment advisors, given their early uptake and the strong interest from retail investors. However, institutional adoption appears limited to date. In the NACUBO-Commonfund Study of Endowments for fiscal year 2023, only 23.2% of all endowments indicated that their investment policy statements allow for investment in digital assets.

The new products have spurred similar products in other jurisdictions, including Hong Kong, Australia, Thailand, and the U.K., and may spur additional foreign products. In the U.S., the SEC approved eight spot ethereum ETFs in late May, but based upon comments by Gensler following the approvals, it remains unclear whether we will see additional crypto product approvals.

There has been movement in the U.S. Congress on crypto legislation. On May 20, 2024, the Senate voted to repeal the SEC staff accounting bulletin SAB 121, which imposed strict accounting and disclosure requirements on companies holding digital assets for their companies. The repeal of SAB 121 would make it easier for banks to custody crypto assets. On May 22, 2024, the House, with strong bipartisan support, passed the Financial Innovation and Technology for the 21st Century Act (the “Act”), a crypto market structure reform bill that would pave the way for a comprehensive federal regulatory framework.

Despite the repeal of SAB 121 by the Senate and bipartisan support in the House for the Act, President Biden vetoed the repeal of SAB 121. In addition, the Biden administration released a statement opposing the Act. In the statement, the administration noted that it “is eager to work with Congress to ensure a comprehensive and balanced regulatory framework for digital assets,” but that it believes the Act “lacks sufficient protections for consumers and investors.”

Conclusion

While there appears to be momentum building for adoption of a comprehensive crypto regulatory framework and the approval of spot bitcoin and ethereum ETFs mark significant developments for the crypto industry, clients should be cautious when considering potential crypto investments. Crypto assets are volatile and highly correlated to each other, which suggests that they may be driven more by speculation than fundamentals. The industry remains nascent and the regulatory uncertainties pose significant risks.

While institutional investment remains limited, we believe it will be an important factor that will influence future developments in the crypto industry. At this stage, we believe crypto assets should be viewed as venture-like projects. We will continue to monitor institutional adoption and provide further updates and guidance as warranted. Please reach out to your investment team with any questions or for further information. ■

[1] SEC, “Investment Adviser Statistics Report.” (May 2024) [2] AdvisorHub, “Morgan Stanley Explores Letting Brokers Recommend Bitcoin ETFs: Sources,” (April 2024) [3] Bitwisel “Bitwise/VettaFi 2024 Benchmark Survey of Financial Advisor Attitudes Toward Crypto Assets,” (Jan 2024) [4] NYDIG, “The Implications of Bitcoin’s Fourth Halving” (April 2024) [5] Van Eck, “Bitcoin Halving Explained: History, Impact, & 2024 Predictions.” (April 2024) [6] KPMG, “Bitcoin’s role in the ESG Imperative,” (June 2023) [7] The Bitcoin ESG Forecast (Jan 2024)

All commentary contained within is the opinion of Prime Buchholz and is intended for informational purposes only; it does not constitute an offer, nor does it invite anyone to make an offer, to buy or sell securities. The content of this report is current as of the date indicated and is subject to change without notice. It does not take into account the specific investment objectives, financial situations, or needs of individual or institutional investors. Information obtained from third-party sources is believed to be reliable; however, the accuracy of the data is not guaranteed and may not have been independently verified. Performance returns are provided by third-party data sources. Prime Buchholz does not recommend spot bitcoin ETFs generally or any of the specific spot bitcoin ETFS mentioned in this investment perspective. This report is intended to provide an informational overview of such investments rather than a recommendation for or endorsement of use by the client. Due diligence and monitoring of strategies or products that are not Prime Buchholz-recommended is less rigorous than the level of due diligence applied to recommended managers and products. Also, because products were not recommended by Prime Buchholz, they are not actively assessed relative to changes in Firm recommendations (i.e., watch list and/or sell recommendations). Reports provided to clients regarding strategies or products that have not been recommended by Prime Buchholz are for informational purposes only and do not constitute our endorsement of the strategy or product. Past performance is not an indication of future results. © 2024 Prime Buchholz LLC

BY RUSSELL HARRIS, CFA, CAIA

BY RUSSELL HARRIS, CFA, CAIA

Associate Director, Research