Education, Perspectives

Investment Perspective: Community Foundations – Driving Impact in a Dynamic Landscape

Jun 21, 2024

Back to all posts.For over 100 years, community foundations have served as important partners in their communities, as grant-makers to nonprofits, sources of scholarship funds, and providers of general philanthropic support to address community needs. As public charities dependent on broad public funding, community foundations face increasing complexities managing their assets and the stakeholders they represent.

When Frederick Goff started the Cleveland Foundation in 1914, his intentions were as practical as they were philanthropic. Prior to this concept of a community foundation, individual donors created small charitable trusts for their giving, managed by a local bank. The newly created trust allowed these assets to be pooled into a single entity governed by local citizens and existing into perpetuity. This community foundation model not only relieved banks of grant-making responsibilities, but also allowed the foundations to meet the changing needs of their communities.

When Frederick Goff started the Cleveland Foundation in 1914, his intentions were as practical as they were philanthropic. Prior to this concept of a community foundation, individual donors created small charitable trusts for their giving, managed by a local bank. The newly created trust allowed these assets to be pooled into a single entity governed by local citizens and existing into perpetuity. This community foundation model not only relieved banks of grant-making responsibilities, but also allowed the foundations to meet the changing needs of their communities.

The concept of community foundations became popular during the Gilded Age of the 1920s and spread rapidly across the country. Today, there are nearly 900 community foundations in urban and rural areas across the United States. The largest 100 community foundations in the U.S. represented more than $110 billion in assets and accounted for over $14 billion in grantmaking in 2022, according to the Council on Foundations. By managing and distributing assets locally, community foundations provide crucial support to nonprofits, addressing needs often overlooked by private philanthropy.

In this investment perspective, we reflect upon the challenges facing community foundations and share strategies to enhance their impact by strengthening the resilience of their investment portfolios.

Current Environment

Managing the assets of a community foundation today is complex and involves many stakeholders. With a business model that necessitates continual annual fundraising, community foundation boards and executive directors must not only manage internal staff but also donors who may want to influence how their funds are invested and distributed.

While private foundations typically consist of a single endowed fund, community foundations often have different funds―tailored to individual donor specifications―that are earmarked for specific purposes. In addition, the growth of donor-advised funds (DAFs) administered by community foundations has created additional complications in managing asset pools with varying lifetimes.

Meanwhile, many community foundations are experiencing rising pressure internally and externally to adopt mission-aligned investment strategies that connect investment decisions with philanthropic values.

Asset Management

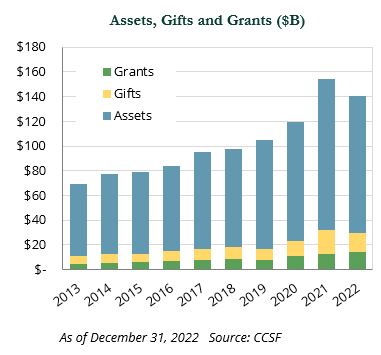

Community foundations have been challenged to maintain asset and gifting levels during periods of decreased fundraising and market downturns, such as 2022. In calendar year 2022―a period when U.S. equities declined nearly 20%―84% of community foundations that participated in the 2022 Council on Foundations–Commonfund Study of Investment of Endowments for Private and Community Foundations (“CCSF”) experienced a decline in assets and 50% reported a decrease in fundraising from the year prior. Despite this, in response to the greater need in their communities, community foundations continued to increase their grantmaking in 2022 by an average of 7%.

To fulfill their missions and support their communities during times of greatest need, community foundations need to take advantage of growth opportunities in their investment portfolios and deploy appropriate hedges that may protect during market downturns.

In Prime Buchholz’s own survey of community foundation clients, many expressed that the development of a robust private market program was particularly challenging due to their unique liquidity needs. Private market funds have the potential to meaningfully outperform public markets, but also carry much greater risk of loss and typically lock up assets for extended time periods. Absolute return strategies (i.e., hedge funds) have the potential to provide better risk-adjusted returns in times of market dislocation and protect portfolios during market downturns as we saw in 2022.

Donor-Advised Funds

Another unique challenge facing community foundations is the proliferation of DAFs, which are dedicated accounts for charitable giving that are sponsored by nonprofits. While the first DAF was funded in 1931, they gained popularity in the 1990s with the launch of Fidelity Charitable in 1991. By 2020, over 600 community foundations housed DAFs on behalf of their donors; DAFs now represent an important source of administrative fee income to those foundations[1].

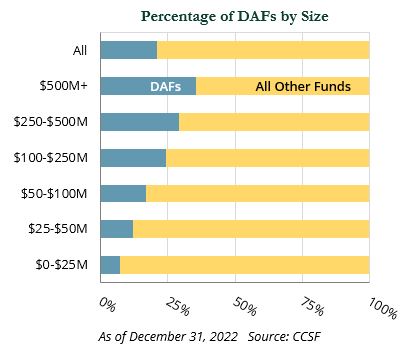

DAFs have grown in their share of the asset base within larger, urban foundations, which benefit from access to a larger population of wealthy donors.

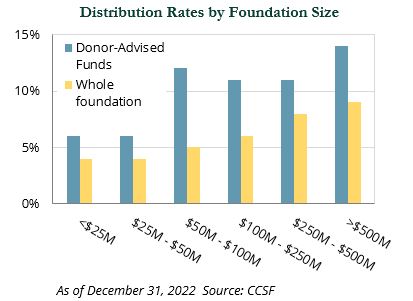

While foundations benefit from a larger asset base, managing more DAFs presents challenges, as they often require greater internal resources and time to meet donor needs. DAFs also tend to have a higher payout ratio on average than the foundation’s endowed funds (11% vs. 6%, according to the CCCSF study). In addition, the largest foundations with the most assets held in DAFs have the highest distribution rates.

The rapid growth of DAFs has not gone unnoticed by the IRS, which is currently considering regulatory changes that would impose greater scrutiny and restrictions on how DAF assets are used and distributed[2]. This could potentially impact donors’ willingness and/or ability to make gifts. Organizations that offer DAFs, along with a handful of other philanthropy groups, have spent millions of dollars in an effort to block legislation to force DAFs to distribute more to charity. This includes a coalition of community foundations that spent $900,000 on lobbying efforts[3].

Mission-Aligned Investing (MAI)

While many community foundations have traditional investment programs with prescribed asset allocations, an increasing number are attempting to align their investments with their missions. There are several potential approaches to mission-aligned investing, including investments ranking high in sustainability criteria, “impact” investments that seek to provide a social or environmental benefit, and diverse managers (managers owned by and/or funds managed by women, people of color, or other underrepresented groups).

In addition to differing MAI approaches, there is a variety of implementation options. A foundation may consider a broad MAI overlay for its entire portfolio, which could include a combination of screened, sustainable, and diverse investments. Foundations can also take a carve-out approach and create a specific fund for their mission-aligned investments. This approach is most often used when impact investments are involved, as organizations seek to separate the risk/return profile of the mission-aligned investments from their traditional investments. Another strategy is to create a separate MAI pool of assets.

Place-based investing, designed to yield both positive financial and social and/or environmental returns in specific communities, has become increasingly popular amongst community foundations. They can be public or private, fully liquid or less liquid; some examples include investing in loan funds that support local affordable housing, lending to a local community development financial institution (CDFI), or lending or investing directly in a local for-profit enterprise.

MAI approaches also provide an opportunity for organizations to engage with donors. As with any investment strategy, an appropriate investment policy statement and risk measurements and controls are necessary to ensure the foundation meets its liquidity and growth goals.

The Prime Buchholz Difference

Prime Buchholz has been serving community foundations for over 30 years. At the start of any client relationship and on an ongoing basis, we meet with the client and its stakeholders to understand the goals and needs of the organization. We seek to build portfolios of top-tier managers that both align with the organization’s mission and achieve its performance goals. We customize each portfolio and regularly engage with clients to understand their changing needs. In April 2024, we hosted a two-day roundtable with community foundation clients to discuss the unique opportunities and challenges they face.

Following are some characteristics that make Prime Buchholz unique:

- Longstanding Partner – We have over 30 years of experience working closely with community foundations. We seek to become an extension of the organization and a trusted partner.

- Advisor to All – Our community foundation clients range from less than $50 million to $2 billion in assets, which enables us to understand the complexities involved in managing various sizes and types of asset pools. We meet our clients’ needs as they evolve, from a non-discretionary advisory role to trade implementation to discretionary OCIO portfolio management services.

- Mission Alignment – We have expertise in aligning portfolios with our clients’ mission and guidelines. Approximately one-fourth of our total clients and nearly one-third of our community foundation clients have implemented mission-aligned investment strategies and we have over 30 professionals working on mission-aligned efforts.

- Engagement – We have expertise in educating and engaging committees, investment staff, donors, and communities. We have a variety of tools designed to help foundations, and provide clients direct access to our research staff.

- Access – We have access to what we consider best-in-class fund managers across asset classes. Our research team regularly adds to our recommended managers/funds on behalf of clients.

- Ongoing Support – We provide consolidated, customized reporting and robust analytics through PrimePlus, our proprietary online data analytics tool. This platform provides our clients with distinctively unique portfolios insights.

Conclusion

Community foundations face growing complexities in both their business model and investment management. Foundation staff, investment committee members, and donors are all important stakeholders with viewpoints to consider.

Prudent asset management is paramount during times of economic distress and market corrections, to ensure the foundation can maintain or grow levels of support to the community. Mission-aligned investment strategies have become increasingly popular among community foundations nationwide. Although these strategies provide opportunities to advance the mission and engage donors, they must be evaluated and managed with the same rigor as any other portfolio investments. Prime Buchholz has a long history of helping clients achieve their goals, whether fixated on bottom-line returns or structuring a portfolio that reflects the values of the organization. Like community foundations, our primary goal is to adapt to your needs by working with you to overcome challenges and develop strategies to ensure our clients grow and thrive.

Please reach out to info@primebuchholz.com for more information. ■

BY LISA SEBESTA

BY LISA SEBESTA

Consultant