At Prime Buchholz, Education, Perspectives

Investment Perspective: Efficiency-Driven Value Enhancement

May 17, 2024

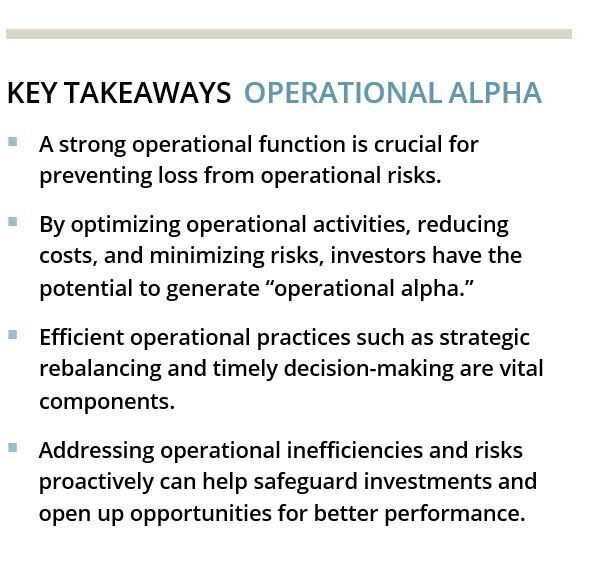

Back to all posts.Effective fund management is often considered the primary driver of investment performance. While this has generally been true, solid operational oversight can also be a source of value creation. Uninvested cash, a failed trade, or worse—becoming the victim of wire transfer fraud—all have the potential to quickly erode hard-earned investment performance.

Conversely, strategic rebalancing, participation in attractive time-sensitive opportunities, and efficient decision-making has the potential to generate portfolio performance, or “operational alpha.”

Potential operational risks include:

- Fraud/Cybersecurity failures

- Human error

- Poor or delayed execution

- Interrupted business continuity

Operational alpha refers to the concept of generating value by optimizing the operational aspects of institutional fund management. This involves reducing transaction costs, improving execution efficiency, and minimizing operational risks. By focusing on these operational aspects, we believe investors can not only better safeguard their portfolios from pitfalls, but also potentially unlock positive performance.

In this investment perspective, we will examine the multifaceted role and significance of operational alpha from the viewpoint of an outsourced investment office, including implementation, trading, and custody services.

Approach Matters

The responsibilities of outsourced investment offices extends beyond institutional fund management. Increasingly volatile and complex markets provide many opportunities for the modern investors to capture value from operational efficiencies.

At Prime Buchholz, our OCIO model employs the following methods, designed to optimize the potential positive performance impact of operational alpha:

Real Time Monitoring

Portfolio allocations are monitored on a daily basis and rebalanced as needed. This includes monitoring for cash inflows and redeploying as appropriate, allowing clients to remain fully invested.

Efficient Decision-Making

Our CIOs have the authority to react to dynamic circumstances and make portfolio decisions based on the current market landscape.

Ability to Act Quickly

Our deep operational capabilities, along with efficient decision-making process, allow us to act swiftly to take advantage of opportunities. This can be particularly impactful when there is a narrow window to access limited capacity alternative investments we believe have the potential to add value.

Execution Best Practices

Our experience working with various vendors provides a thorough understanding of the universe of custodian banks, transition managers, and third-party brokers, allowing us to seek the ultimate balance of efficiency and effectiveness.

Efficient Administration of Private Program

There are unique operational challenges to running a private program, including paying capital calls, monitoring distributions, and executing limited partnership amendments. We have expertise in this area that help with efficiencies.

Deep Understanding of Liquidity

Understanding capital availability is critical during the transition planning process. Our systems are created to monitor and plan for liquidity needs.

Potential Fee Savings

Prime Buchholz’s relationships with managers and client base allows our clients to access lower fees and minimum investments for many products. Also, we actively monitor fund asset levels and proactively upgrade share classes, as asset levels permit.

Efficient & Effective Trading

An emphasis on both execution and risk mitigation is paramount when refining trading strategies. As an OCIO, we play a pivotal role in navigating the complex regulatory landscape, implementing risk management strategies, and optimizing trading practices.

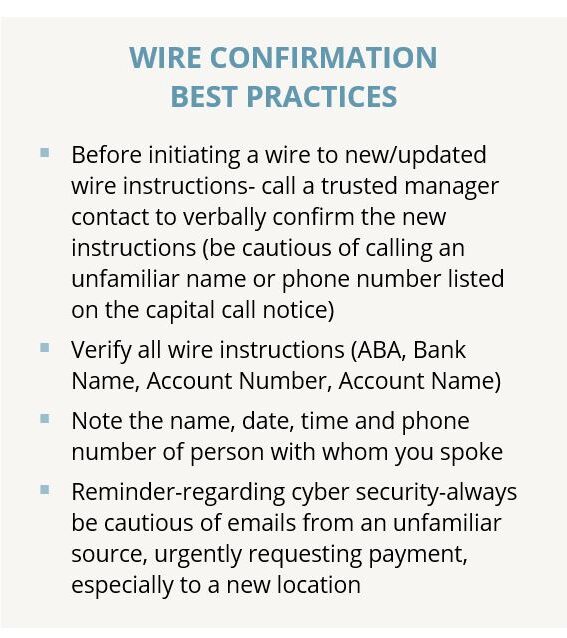

Attempts at wire fraud have surged in recent years, making it critical for organizations to implement strong trading and verification processes. It is vital to confirm that investment-related communications are from a trusted party, particularly when movement of capital is involved. Fraud surrounding the payment of capital calls is a particular concern. We verbally verify all new and changed wire instructions with a trusted manager contact before funds are sent.

As an OCIO, we actively seek ways to add value during the trading process, including enhanced trading efficiency, reduced transaction costs, and optimized execution strategies.

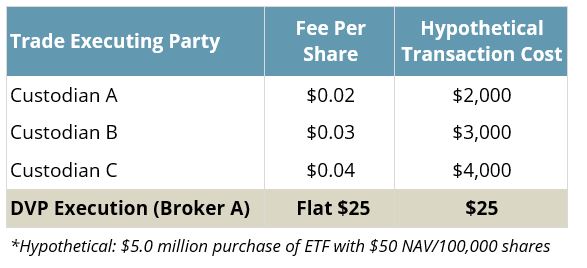

Many investors will default to executing ETFs & individual stock trades through their custodian’s trade desk. Often, one way to add value is by executing trades using Delivery Versus Payment Trade Execution (DVP) with third-party brokers. This has the potential to materially lower transaction costs while maintaining the settlement and safe keeping of assets with the custodian. Below is a sample trade intended to illustrate the potential fee savings:

The Role of Technology

Technology plays a critical role in our approach to institutional fund management and trade execution, which led us to create enhanced real-time portfolio monitoring tools. Leveraging our proprietary online analytics platform, PrimePlus®, our investment teams have a clear understanding of portfolio exposures and current cash positions.

Our team uses this data for transition planning, rebalancing, private capital assessments, and cash planning purposes. Approved trades are initiated within our system and follow procedures, commencing with confirmation of trade execution.

Clients can utilize these enhanced portfolio analytics and powerful online tool for no additional fee. Our OCIO clients appreciate the ability to directly access portfolio activity 24/7 through PrimePlus®.

Importance of Custodial Services

The principles behind operational alpha extend to custodial services, emphasizing the importance of safeguarding assets and efficient execution. We believe most organizations with institutional investment portfolios should utilize a custodian. In addition to safekeeping assets and providing a consolidated book of record, a master custodian can reduce burdensome administrative tasks and the risks associated with portfolio transitions.

As an OCIO, we collaborate with custodial partners to perform various operational services, including:

- Consolidated reporting of assets

- Trade execution and settlement

- Cash management

- Asset valuation

- Treatment of investment distributions

Our expertise helps ensure that our clients’ custody banks provide a secure and robust foundation for their diverse portfolios.

Concluding Thoughts

Operational alpha serves as a catalyst for innovation and thoughtfulness throughout the fund management process. This extends to risk management, decision-making governance, implementation, trade execution, and custodial practices.

As an outsourced investment office, we are instrumental in integrating and implementing sound principles across these domains. Operational alpha is not merely a strategy; it is a comprehensive framework of processes that enhances, secures, and optimizes the entirety of our investment management.

Please reach out to info@primebuchholz.com for more information.

STEPHEN ROCHE

Principal/Senior Director, Client Services – OCIO

Indices referenced are unmanaged and cannot be invested in directly. Index returns do not reflect any investment management fees or transaction expenses. All commentary contained within is the opinion of Prime Buchholz and is intended for informational purposes only; it does not constitute an offer, nor does it invite anyone to make an offer, to buy or sell securities. The content of this report is current as of the date indicated and is subject to change without notice. It does not take into account the specific investment objectives, financial situations, or needs of individual or institutional investors. Information obtained from third-party sources is believed to be reliable; however, the accuracy of the data is not guaranteed and may not have been independently verified. Performance returns are provided by third-party data sources. Past performance is not an indication of future results. © 2024 Prime Buchholz LLC