Higher education endowments are operating in one of the most challenging environments in recent memory. Market volatility, evolving asset class dynamics, regulatory uncertainty, and shifting societal expectations around mission-aligned investing are forcing institutions to rethink how they build and manage portfolios for the long term.

Recent political headlines—such as calls to revoke Harvard’s tax-exempt status—underscore the heightened scrutiny facing large endowments and their role in institutional strategy.

The traditional pillars of endowment investing—diversification, illiquidity premiums, and manager selection—remain foundational but are facing new pressures. Private equity markets are navigating a multi-year adjustment phase with fewer exits and greater valuation uncertainty. Hedge fund allocations continue to be evaluated with a critical lens. And growing political discourse around fossil fuel divestment and ESG has introduced new reputational and financial complexities.

In this investment perspective, we explore how structural market shifts, governance challenges, and evolving investment strategies are reshaping endowment management—and how institutions can stay focused on long-term objectives while adapting to a fast-changing world.

Strategizing for a Changing Market

Today’s markets demand more than returns; they require strategic clarity and resilience. Endowments must balance long-term discipline with sharper focus on liquidity, private markets, and portfolio design.

Long-Term Discipline > Short-Term Noise

Despite market turbulence, we believe long-term results continue to validate disciplined investment approaches. While there has been volatility year to year, as well as a few lean years (e.g., FY20 and FY22), 10- and 15-year annualized results reinforce a core principle of endowment stewardship: long-term discipline can drive enduring success.

Temporary dislocation should not undermine sound policy. We go to great lengths to collaborate with our clients to build a policy framework that incorporates their financial picture and enterprise risk considerations. We also communicate downside scenarios resulting from different market stresses. In doing so, we believe this front-runs the need to consider pivoting in the eye of the storm or making reactionary adjustments that could be detrimental over the long term.

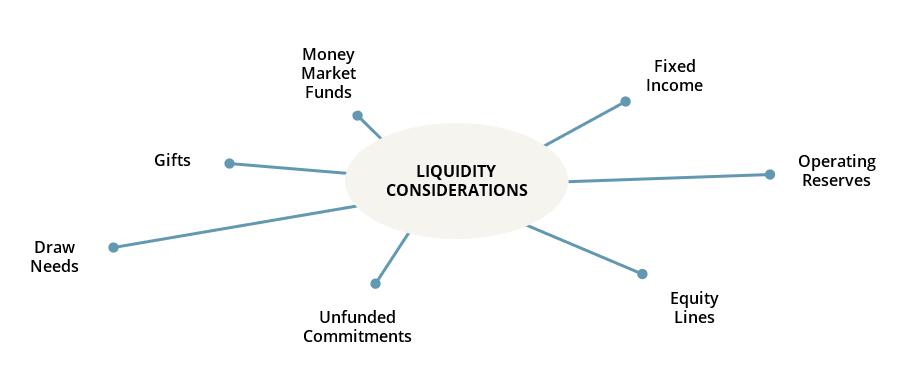

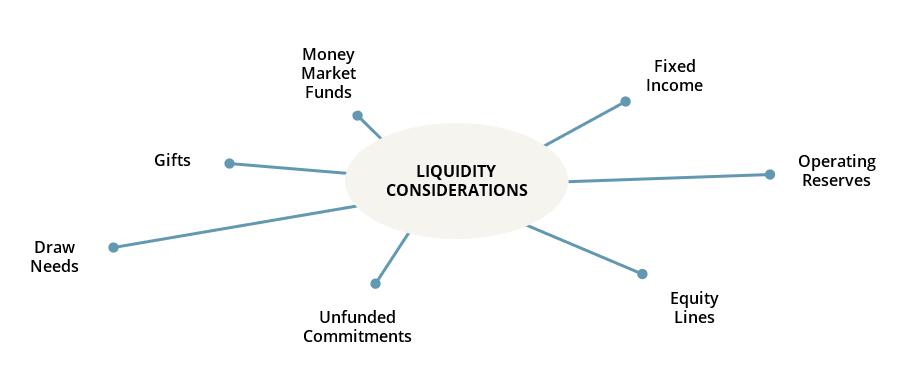

Liquidity as a Strategic Asset

Liquidity is an underappreciated yet critical component of portfolio resilience. As Yogi Berra famously said, “If you don’t have it, that’s why you need it.” It can be challenging—and costly—for institutions seeking to generate liquidity to move with precision during periods of acute market stress. Effective pacing models, access to operational reserves, debt facilities, and thoughtful planning around endowments are all crucial for flexibility.

In portfolios with significant exposure to private markets, liquidity is no longer a passive outcome; it is a strategic consideration. The pandemic and other dislocations underscored the need to model a range of cash need scenarios.

We work with clients to integrate liquidity planning into asset allocation, helping build dry powder reserves that support operations, enable opportunistic rebalancing, and sustain flexibility through market disruptions.

Private Markets: Recalibrating Expectations

Private equity and venture capital have become cornerstone exposures for many institutions, reflecting their long-duration profile and potential for outsized returns. The “illiquidity premium” inherent in these strategies (generally 3-4% over long-term market cycles) has been durable over time. Still, it remains challenged in the current environment as public equities have outperformed recently.

Private equity fund drawdown windows have been prolonged and exits are below expectations. Recent short-term performance and liquidity challenges—particularly in venture capital—have prompted many investment offices to revisit pacing models and assumptions. In some cases, institutions are turning to the secondary market for liquidity.

Institutions are adapting by reinforcing their commitments within outlined pacing ranges, modeling extended liquidity scenarios, and re-underwriting assumptions. We believe private market strategies remain valuable, but implementation is key. Greater consideration should be given to the attributes—duration, style, liquidity, cash flow dynamics, etc.—of the program. The current macro backdrop requires more active liquidity management and sharper scenario analysis than ever before.

Hedge Funds: Defining Their Role

The endowment model historically embraced hedge funds for diversification and downside protection. Yet, over the last decade, many institutions have pared back exposure due to high fees, inconsistent performance, and limited transparency.

While many endowments have reduced their hedge fund allocations, a well-structured hedge fund portfolio can still play an important role in client portfolios. Hedge funds have the potential to diversify sources of return, lower total portfolio volatility and market sensitivity, and take advantage of market dislocations. Hedge fund programs can also be designed to meet each client’s specific liquidity needs.

From Manager Selection to Portfolio Architecture

We partner with investment committees from the start to design resilient policy portfolios that reflect each institution’s distinct spending needs, liquidity profile, and mission. We believe robust rebalancing frameworks, scenario testing, and long-term capital market assumptions can drive successful outcomes more than potential manager outperformance. We also believe it is important to take active management risk in less efficient areas of the capital markets, where the opportunity for generating excess returns may be greater. Using passive implementation in highly efficient areas helps investors control costs and lock-in market beta.

We work with clients to develop customized, risk-aware strategies built to support institutional missions while adapting to market complexity. Our proprietary analytics platform, PrimePlus®, helps clients evaluate risk and opportunity by providing real-time performance details, private capital tracking, stress testing, and mission alignment metrics.

Learn more about how PrimePlus® is transforming how clients engage with their portfolios.

Governance in a Shifting Landscape

Current governance challenges extend beyond portfolio management. Institutions must navigate an increasingly complex environment shaped by political scrutiny, shifting federal policy, and operational pressures.

Federal Policy Risk & Operational Pressures

Governance today must also account for broader risks to institutional finances. Proposed cuts to federal funding, changes to research support, and potential liability for unpaid student loans introduce operational challenges that could strain budgets and pressure endowment spending. Hundreds of college presidents recently sent a letter to the Trump administration protesting these measures. Even if the proposals are not passed, uncertainty alone could complicate long-term planning.

Institutions must proactively model these risks, assess their potential impact on liquidity and spending policy, and strengthen coordination between investment committees, finance teams, and leadership. Preparing for financial disruption is essential to preserving both investment discipline and mission continuity.

ESG in the Political Crosshairs

Over the past decade, many institutions have embraced ESG integration, adopting climate-aware policies, setting net-zero targets, or divesting from fossil fuels. These actions often reflect institutional missions and are initiated by stakeholders such as students, donors, and boards.

However, the political landscape has shifted. ESG-related decisions are now subject to greater scrutiny. Potential deregulation could create relative performance risks for those that fully divested from fossil fuels. In this environment, it is critical for institutions’ investment governing bodies to clearly define how mission alignment fits within their fiduciary duties—and to communicate consistently with stakeholders.

Governance in the Public Eye

Investment decisions are increasingly under public scrutiny from lawmakers, donors, and media outlets. Strong governance frameworks—rooted in transparency, mission, communication, and well-documented processes—help institutions defend decisions and stay focused on long-term objectives amid external pressures.

By maintaining a disciplined approach to governance, institutions will be better equipped to defend decisions—even in polarized environments—and remain focused on strategic objectives.

Leaner Teams, Deeper Partnerships

Higher education finance teams often operate with lean staff, even as portfolios become more complex. Many adapt to this change by leaning more on the partnerships they have built with their investment advisors, either through a fully outsourced or hybrid service model. These models allow internal staff and decision makers to focus on oversight and mission alignment rather than administrative and operational burdens.

Our flexible service models adapt across governance structures—from traditional consulting to full OCIO—allowing institutions to choose the partnership structure best aligned with their needs. Regardless of model, Prime Buchholz emphasizes partnership, transparency, and access to resources across our research, operational, and technology teams.

Looking Ahead

The future of endowment management will be defined not by a single asset class or political issue, but by the ability of institutions to act deliberately in the face of uncertainty. Investment committees and staff must balance a complex array of challenges:

- Changing macroeconomic conditions, including inflation and interest rate volatility

- Persistent illiquidity risks and recalibrated return expectations in private markets

- Political and reputational pressures tied to ESG and fossil fuel exposure

- Stakeholder demands for transparency, impact, and accountability

Strategic clarity—anchored in strong investment policy, disciplined rebalancing, and thoughtful governance—will differentiate resilient institutions.

Conclusion

The endowment model remains a powerful engine for advancing higher education missions. Yet today’s rapidly shifting landscape is challenging many assumptions that underpinned decades of success. Institutions require more than strong investment performance—they need strategic clarity, operational agility, and well-defined purpose.

Our independent, client-first model and long-term investment philosophy are built for moments like these. We’re proud to support colleges and universities in securing their financial futures and advancing their missions—and welcome the opportunity to discuss this further.

Please reach out with any questions. ⬛

All Rights Reserved. Note: Data is continuously updated and therefore subject to change. Indices referenced are unmanaged and cannot be invested in directly. Index returns do not reflect any investment management fees or transaction expenses. All commentary contained within is the opinion of Prime Buchholz and is intended for informational purposes only; it does not constitute an offer, nor does it invite anyone to make an offer, to buy or sell securities. The content of this report is current as of the date indicated and is subject to change without notice. It does not take into account the specific investment objectives, financial situations, or needs of individual or institutional investors. Information obtained from third-party sources is believed to be reliable; however, the accuracy of the data is not guaranteed and may not have been independently verified. Performance returns are provided by third-party data sources. Past performance is not an indication of future results. © 2025 Prime Buchholz LLC