Gregory C. Berry

Principal/Associate Director, Research

The rapid evolution of artificial intelligence (AI) has been one of the most transformative forces in technology, reshaping industries, markets, and investor sentiment. Over the past year, AI-powered innovation drove significant gains in the tech sector, with companies like Nvidia and Broadcom benefiting from surging demand for AI infrastructure. However, recent developments have cast uncertainty over the AI theme, as emerging competition and shifting market dynamics trigger volatility and force reassessments of valuations.

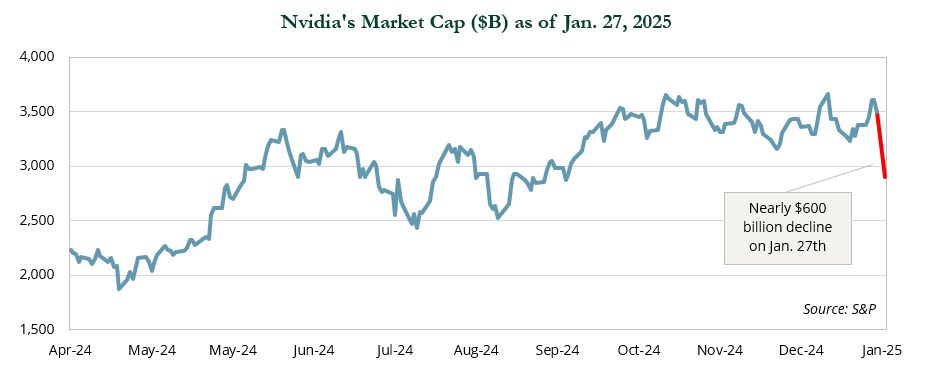

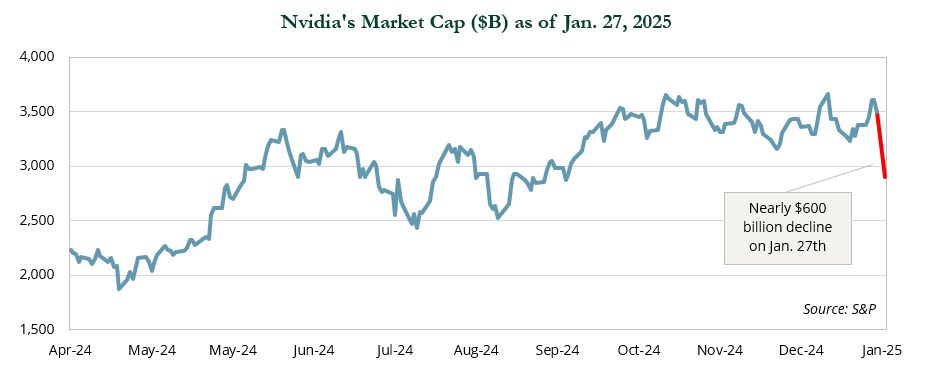

In a striking example, Nvidia—a leader in AI-enabling hardware—saw its market value decline by 17% on Monday, erasing nearly $600 billion from its capitalization. Similarly, Broadcom experienced a dramatic 17% decline, shedding $200 billion in value.

Combined, these losses accounted for the entirety of the 1.5% decline in the S&P 500 on Monday. Companies reliant on the growth of demand for AI infrastructure and semiconductors—including Taiwan Semiconductor (−13.3%) and Astera Labs (−28.0%)—also faced sharp declines, underscoring the fragility of these high-growth areas, and highlighting how valuations can become stretched for some companies caught up in the trend.

Even following Monday’s 17% decline, Nvidia remains by far the most meaningful driver of S&P 500 gains since the start of 2023. Reflecting its volatility, Nvidia has accounted for 8 of the 11 largest single-day market cap losses on record since April 2024, each exceeding $200 billion. For context, Monday’s nearly $600 billion loss is equivalent to wiping out the combined market caps of Walt Disney, Goldman Sachs, and Philip Morris.

In this investment perspective, we share observations on the recent market movements, highlight key developments in AI, and provide context for institutional investors to consider moving forward.

Broader Market Dynamics

While parts of the tech sector suffered significant losses, the declines were concentrated in AI hardware and semiconductor companies—rather than the sector as a whole. Software companies focused on “agentic AI” displayed resilience and even strength amidst the broader sell-off. For example, Salesforce (+4.0%), ServiceNow (+1.4%), Atlassian (+1.2%), MongoDB (+1.0%) and Snowflake (+0.8%) appeared to benefit from a rotation into AI-driven SaaS stocks.

Outside the tech sector, the Dow rose 0.7% and closed on its highs, driven by strong performance in financials, flows into consumer discretionary, and a relatively positive sentiment in most things not directly connected to AI infrastructure.

While the S&P 500 rallied off lows to close down 1.4% for the day, the equal-weighted S&P 500 ETF (RSP) finished the day positive, highlighting the concentrated nature of the tech sell-off. This divergence in performance between subsectors underscores the importance of diversification within portfolios, especially during periods of heightened market volatility.

Observations on Recent Activity

Emergence of Cost-Effective Competitors

DeepSeek, a Chinese AI startup, recently announced that it developed AI capabilities comparable to industry leaders like OpenAI at a fraction of the cost. This highlights the growing competition in the AI space, which could disrupt established leaders and significantly alter the AI value chain.

Companies like Nvidia and Broadcom, which rely heavily on substantial infrastructure spending from tech leaders, would face headwinds if current levels of spending were to come down.

Ripple Effects Across Sub-Sectors

The sell-off extended beyond hardware and semiconductor firms to power producers and utility companies linked to AI infrastructure, such as Constellation Energy (−20.9%), Vistra (−28.3%), and GE Vernova (−21.5%).

Similarly, stocks linked to datacenter build-out like Dell (−8.7%) and Vertiv (−29.9%) also experienced steep declines, reflecting concerns about the sustainability of AI-driven growth across multiple layers of the value chain. Power demand has been linked to demand for AI datacenters, so a sell-off in these names that have rallied significantly over recent months is understandable. However, investors continue to believe we are behind our ability to meet the growing demand for data centers and electricity in the U.S. even if forecasted AI related demand were to moderate.

Demand for compute and storage is expanding rapidly outside of AI due to ever increasing growth in content consumption, the roll out of 5G and the emergence of the internet of things. Tailwinds for power demand also preceded AI’s explosive growth due to the electrification of corporate fleets and manufacturing processes, growth in electric vehicles, and power for non-AI-related data centers.

Valuation Pressures

The meteoric rise of stocks like Nvidia and Broadcom has left little room for error. Recent corrections underscore concerns about stretched valuations, especially within growth-oriented sectors. As such, the volatility serves as a reminder that even market leaders are not immune to sudden shifts in sentiment.

This trend could be a small hiccup in the AI infrastructure theme or it could indicate broader recalibrations as investors seek to mitigate risks tied to concentrated bets in high-growth sectors.

Considerations

For institutional investors with long-term horizons, these market movements provide opportunities to reassess broader trends and strategies. The rise of cost-efficient competitors underscores the need to monitor competitive landscapes closely.

While such democratization could disrupt established leaders, it also expands the range of investable opportunities over time. Recent price action highlights the importance of diversification within the tech sector, as concentrated bets on specific subsectors can result in significant drawdowns. This risk is particularly evident as the market rotates out of AI building-blocks and into software and SaaS businesses specializing in advanced inference AI models, which are driving the rise of agentic AI.

With that in mind, we continue to emphasize the importance of investing with experts in their respective areas of focus who are on the forefront of emerging trends within their sectors. The resilience of plenty of tech stocks amidst this volatility reinforces the value of diversification within sectors.

Investors in the tech sector do not believe the AI theme is being disrupted or that this is a bubble that needs popping. The broad AI theme may be evolving to include more of the sector and less concentration in what is driving the theme. Increased efficiency and competition should ultimately improve accessibility to new technology, drive further innovation, curate faster and more accurate models, and lead to better business creation.

Conclusion

The recent volatility in AI-related markets reflects the complex interplay of innovation, competition, and market sentiment. The emergence of cost-efficient competitors, coupled with concerns over stretched valuations, may be creating new challenges for established players while opening doors to broader opportunities.

For institutional investors, adaptability and a focus on long-term goals remain crucial as the AI landscape evolves. While the road ahead may be rocky, the transformative potential of AI continues to be a compelling driver of global market dynamics. Partnering with quality investment teams focused on understanding this evolution is an important aspect of investing in this environment. Balancing exposure to both growth-oriented and defensive assets is essential to mitigating risks while capitalizing on evolving trends.

Indices referenced are unmanaged and cannot be invested in directly. Index returns do not reflect any investment management fees or transaction expenses. All commentary contained within is the opinion of Prime Buchholz and is intended for informational purposes only; it does not constitute an offer, nor does it invite anyone to make an offer, to buy or sell securities. The content of this report is current as of the date indicated and is subject to change without notice. It does not take into account the specific investment objectives, financial situations, or needs of individual or institutional investors. Information obtained from third-party sources is believed to be reliable; however, the accuracy of the data is not guaranteed and may not have been independently verified. Performance returns are provided by third-party data sources. Past performance is not an indication of future results. © 2025 Prime Buchholz LLC