By Thomas Lupone

Principal/Senior Consultant

At Prime Buchholz, we encourage investors to maintain focus on the long-term—metaphorically speaking, on the “horizon.” However, we are also pragmatic and understand the inclination to evaluate near-term performance. With that in mind, we share some observations about the fiscal year ended June 30, 2024.

Our educational clients faced and persevered through exceptionally difficult financial and operating environments in the fiscal year. The risks faced by educational institutions felt particularly acute, including deteriorating enrollment and demographic trends, inflationary pressures, and divisive social, political, and cultural events.

We admire their flexibility, creativity, patience, and perseverance.

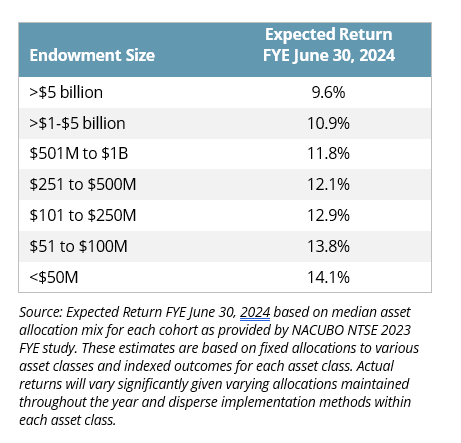

In this investment perspective, we offer return estimates across size cohorts, provide insights into the key drivers of performance, and evaluate the longer-term return differential across large and small educational endowments.

The Importance of June 30th

June 30th is an important endpoint for many educational institutions. Operating goals and financial budgets are routinely assessed over the course of the year, but fiscal year-end represents a particularly important period for reflection—equally from an investment perspective.

It may be that a natural force is at play: peer pressure. Fixing a common endpoint allows for comparison and, for better or worse, encourages competition.

While the annual NACUBO-Commonfund Study of Endowments is a much-anticipated measure offering valuable comparative data, it will not be released until early 2025. We therefore base our commentary on our real-world experience working with nearly 100 educational organizations.

A Very Strong Year

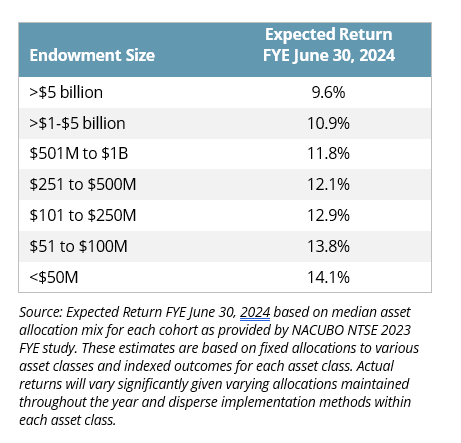

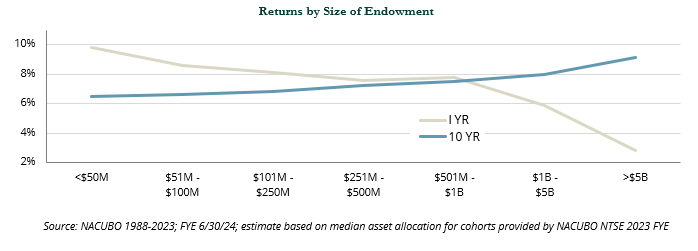

In simple terms, this was a very good year. Based on an early assessment of our clients’ performance, and the general market returns available – we expect low double-digit returns (10-12%) to be the norm with some enjoying mid-teens results (14-15%). Still solid, but slightly less impressive, high single digit outcomes (8-9%) will be common, particularly among the largest endowments.

A key determinant, as always, is asset allocation. The dispersion of returns across and within cohorts will continue to be largely driven by variations in asset allocation. Obvious but important to state——the more one has allocated to higher returning assets classes, the better the return outcomes experienced.

Of note, U.S. stocks returned approximately 3x their long-term average and outperformed the next-best performing category (natural resource equities) by 1.4x. Clearly, a distinguishing factor in this fiscal year is the amount allocated to U.S. stocks.

Private market allocations will likewise play an important role in actual outcomes experienced. With public markets outperforming private markets by a substantial level (the largest dispersion on record), those with larger allocations to private investments will likely reside in the lower range of outcomes for the year.

A Pattern Disrupted

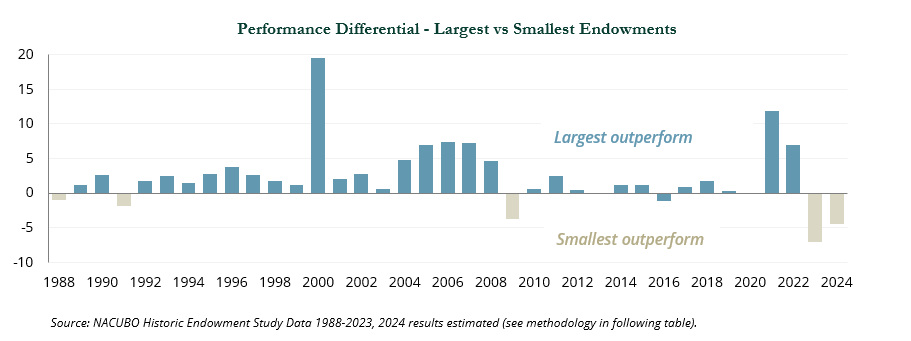

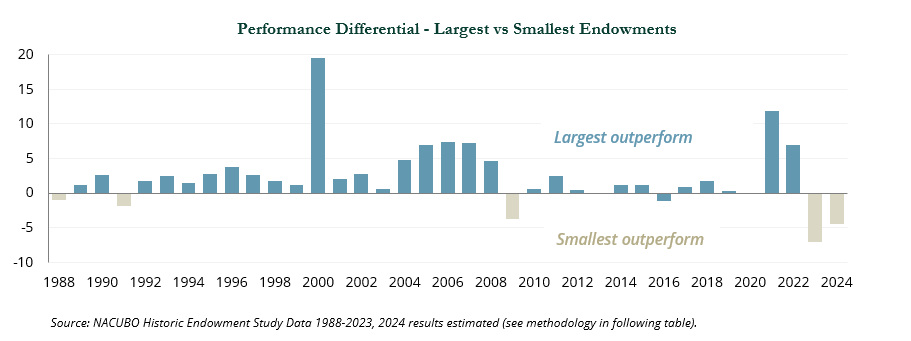

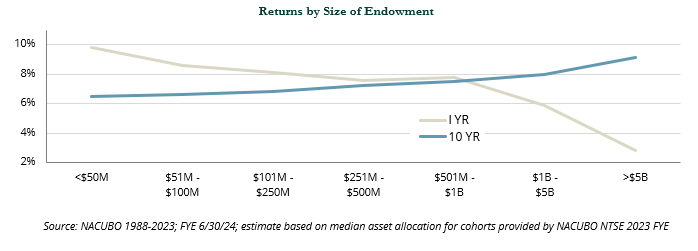

The long-term historical pattern is fairly clear; larger endowments have tended to outperform the smaller ones, resulting in an enormous return advantage over time. However, this reliable pattern was disrupted in FY2024 by a large amount AND for the second consecutive year.

We’ve seen small endowments outperform large endowments on occasion – but never over consecutive years. Fortunately for the larger endowments, and for those deploying endowment-style investment strategies, the years prior suggest significant and sustained advantages. The obvious factor favoring the smaller investor in the near term is the excess return offered by U.S. stocks, where smaller organizations typically have more assets allocated.

The Endowment Style Approach Offered Benefits Over the Long Run

Despite a breakdown in the pattern over the last two years, the historical pattern remains reliable: year after year, the largest endowments have tended to outperform their smallest peers. In fact, based on all data available from NACUBO back to 1988, the largest endowments finished either 1st or 2nd among all size cohorts in 30 of the 37 observations – an approximate 80% hit rate. It is true that when they falter, the largest cohort tend to drop to the bottom of the universe – as they did in FY2024. Looking at the long-term, it is important to acknowledge that excess returns achieved in the good years have allowed larger endowments to maintain a significant long-run advantage.

This fiscal year represented a period of exceptional and disruptive events. In our role, we maintain the long view with an eye on the horizon rather than on short-term results. However, we understand why the June 30 reporting period draws significant attention and emphasis.

We will provide additional perspective as peer studies become available. In the meantime, please reach out to your investment team with any questions. ⬛

Source: 2023 NACUBO-Commonfund Study of Endowments All commentary contained within is the opinion of Prime Buchholz and is intended for informational purposes only; it does not constitute an offer, nor does it invite anyone to make an offer, to buy or sell securities. The content of this report is current as of the date indicated and is subject to change without notice. It does not take into account the specific investment objectives, financial situations, or needs of individual or institutional investors. Information obtained from third-party sources is believed to be reliable; however, the accuracy of the data is not guaranteed and may not have been independently verified. Performance returns are provided by third-party data sources. Past performance is not an indication of future results. © 2024 Prime Buchholz LLC