At Prime Buchholz, Education, Market Updates

PrimePlus® – Revolutionizing Investment Analytics for the Empowered Investor

Jun 13, 2024

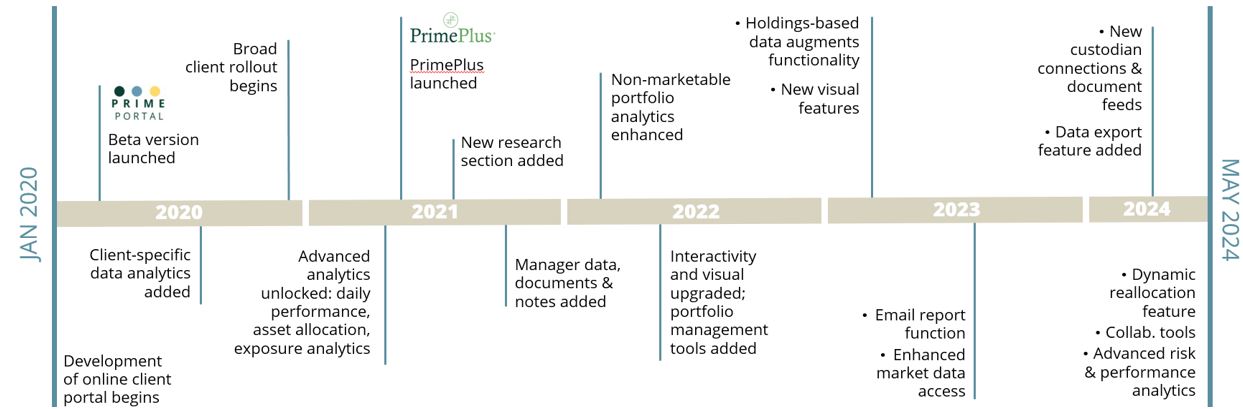

Back to all posts.Since our inception in 1988, Prime Buchholz has been a trusted partner to our clients, driven by a commitment to excellence in service. This dedication has evolved to include technological innovation, culminating in PrimePlus®—our sophisticated portfolio analytics platform designed for institutional investors. PrimePlus® helps users navigate the complexities of data management by seamlessly integrating data collection, synthesis, and visualization into a single, cohesive product.

As seasoned advisors, we believe we are deeply familiar with institutional challenges and uniquely positioned to craft intuitive solutions to complex data problems. PrimePlus® is intended to meet these challenges—a platform thoughtfully designed to transform the client experience. By simplifying the integration of data management, multi-asset class analytics, and third-party systems, this platform has enriched the way our clients interact with their portfolios. Our goal is to revolutionize portfolio oversight by merging our deep investment advisory expertise with advanced technology―to empower clients to focus on strategic objectives through better informed decision-making and streamlined operations.

Key to the Prime Buchholz Experience

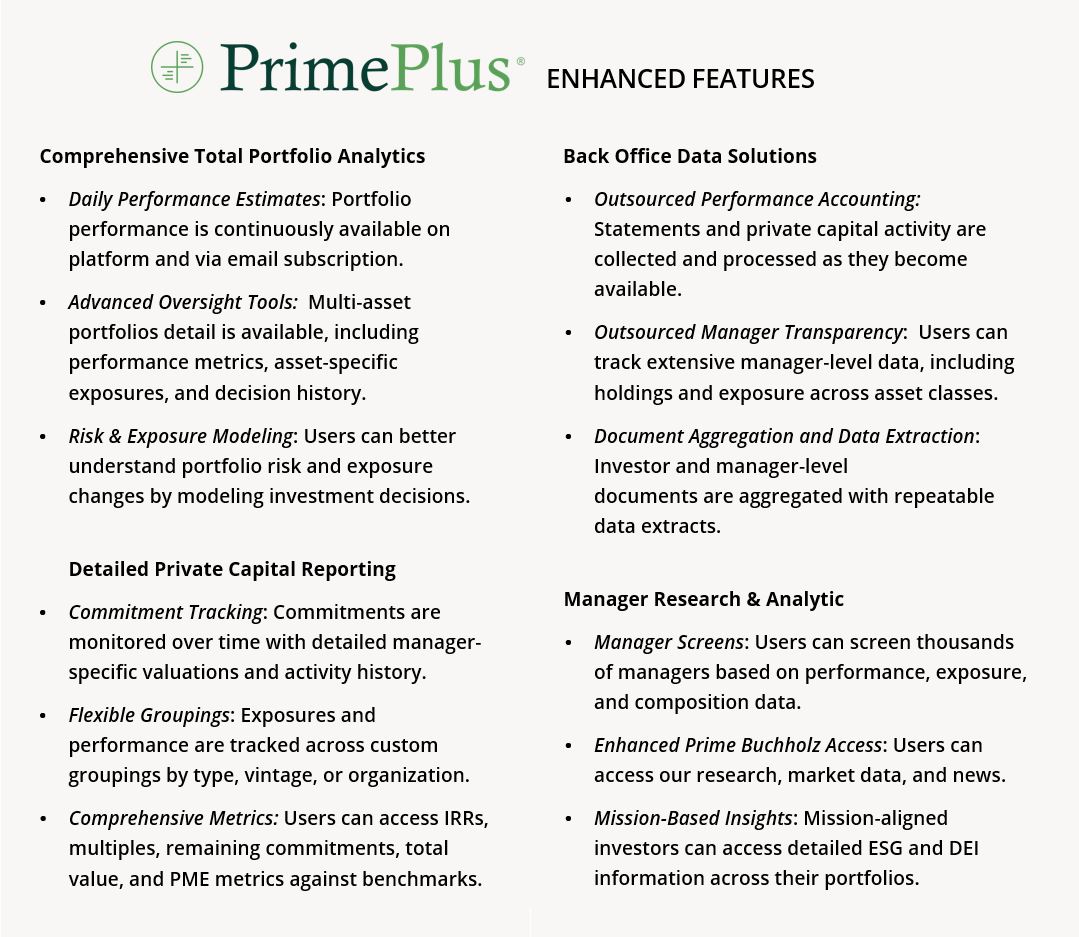

PrimePlus® was specifically designed to help institutional investors meet their dynamic needs. Equipped with advanced interactive data visualization tools, our platform simplifies complex analytics into intuitive interfaces. This enables users to explore the relationships between multiple layers of data, transforming disparate data into readily accessible information.

PrimePlus® extends beyond traditional monthly and quarterly reporting cycles by prioritizing continuously available information. New data is quickly integrated into the platform as it becomes available, ensuring clients have access to the most updated information available. This data flow is not just beneficial during regular reporting periods; it is a critical tool our investment professionals use to provide ongoing support and oversight. This capability strengthens our commitment to fulfilling client needs promptly, empowering them to stay informed in a dynamic market environment.

Our development roadmap is shaped by client feedback and investment professional insights, reflecting our commitment to transparency and collaboration. By actively seeking feedback and prioritizing improvements based on user experiences and needs, we believe PrimePlus® remains at the forefront of technological advancements in portfolio management and oversight.

The Future of PrimePlus®

Enhancing our services to meet the needs of our clients is a hallmark of Prime Buchholz. As such, we are committed to evolving PrimePlus® to meet the demands of an ever-changing financial landscape.

Our near-term roadmap includes improvements to our data tracking capabilities, such as portfolio company data for private capital managers, and major development in forward-looking portfolio planning. These enhancements will leverage knowledge from our existing client processes and channel our relationships with our client partners.

With rapid advancements in AI, and our core competency in clean, structured data across the total portfolio, Prime Buchholz is uniquely positioned to capitalize on new opportunities. Generative AI stands to play a crucial role in advancing our analytical framework, data mining, and reporting capabilities. For example, while traditional reports and charts are invaluable, generative AI enables users to interact with the data that powers their platform experiences.

Our strategic focus also includes ongoing improvements to the user experience, with more interactive and comparative tools, additional datasets, and third-party integrations. By prioritizing innovation, user-centric design, strategic partnerships, and operational excellence, we believe PrimePlus® will continue to strengthen the partnership with our clients.

Concluding Thoughts

PrimePlus® represents a strategic merging of technology and client-centric design, tailored to help meet the dynamic needs of modern institutional investors. By providing comprehensive analytics, daily data updates, and an intuitive user interface, PrimePlus® is an essential tool for enhancing portfolio investment strategies. The platform not only supports detailed investment analysis but also enables a deeper understanding of portfolio dynamics.

The features outlined here offer a high-level overview of the platform’s functionality. We invite you to experience the full potential of the platform through a guided tour, and learn how PrimePlus® can revolutionize your experience.

To explore the capabilities of PrimePlus® further, visit PrimeBuchholz.com/PrimePlus or reach out to your Investment Team to set up a personalized demonstration. If you have any questions or wish to learn more, please do not hesitate to contact me directly: daniel.ricci@primebuchholz.com

BY DANIEL M. RICCI, CFA

BY DANIEL M. RICCI, CFA

Principal/Head of Information Systems

All commentary contained within is the opinion of Prime Buchholz and is intended for informational purposes only; it does not constitute an offer, nor does it invite anyone to make an offer, to buy or sell securities. The content of this report is current as of the date indicated and is subject to change without notice. It does not take into account the specific investment objectives, financial situations, or needs of individual or institutional investors. Information obtained from third-party sources is believed to be reliable; however, the accuracy of the data is not guaranteed and may not have been independently verified. Performance returns are provided by third-party data sources. © 2024 Prime Buchholz LLC