Education, Market Updates, Perspectives

Investment Perspective: China at a Crossroads

Apr 24, 2024

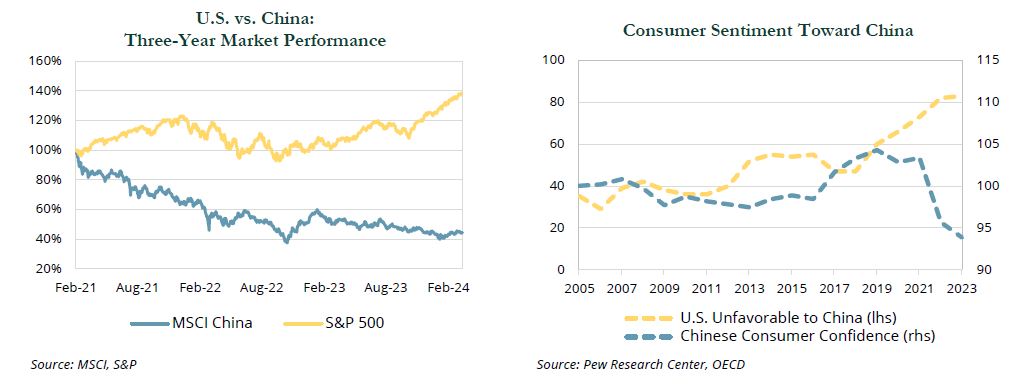

Back to all posts.China stands at a critical juncture, mired in one of its most severe market downturns since the nation’s equity market reopened in 1990. After reaching a near 30-year high in early 2021, the MSCI China Index fell nearly 60% over the following three years.

In early 2021, a series of events negatively impacted Chinese markets, including the collapse in its already struggling property market and a resurgence of COVID. Ideologically motivated policies, such as the country’s draconian zero-COVID policy, exacerbated these headwinds, causing foreign investor and Chinese consumer confidence—as well as faith in the government—to plummet.

Despite this, many of the traits that attracted investor interest in China during the country’s rise remain intact. China is one of the few countries offering robust growth prospects, compelling valuations, and a deep and diverse equity market.

However, without a catalyst to recovery, China’s future may more closely resemble that of Japan in the 1980s, with similarities in deflation, a troubled housing market, and lagging policy response. The coming quarters will be critical in determining if China can reignite its economy, or if it embarks on a lost decade.

In this investment perspective, we examine the factors that could lead to a rebound, as well as risks that could further hinder the Chinese economy.

Path to Recovery

China’s recent issues have been well-publicized, but there is a case for recovery:

- The International Monetary Fund projects China’s GDP to increase an average of 3.9% annually over the next five years—more than all developed and most emerging markets—due to continued urbanization and growth of the middle class.

- China’s urbanization only recently crossed 60%, compared to ~80% for the U.S. and Europe.

- China has resources dedicated to “new economy” areas such as tech, clean energy, automation and healthcare, which supports a transition to consumption-led growth.

Perhaps more important, Beijing has the ability to address some of the most pressing problems as many of the wounds suffered over the past three years were self-inflected. A correction of misguided policies alone would provide relief, which we have seen to some extent with the reversal in the government’s COVID policy and a softer approach to intervention in the private sector.

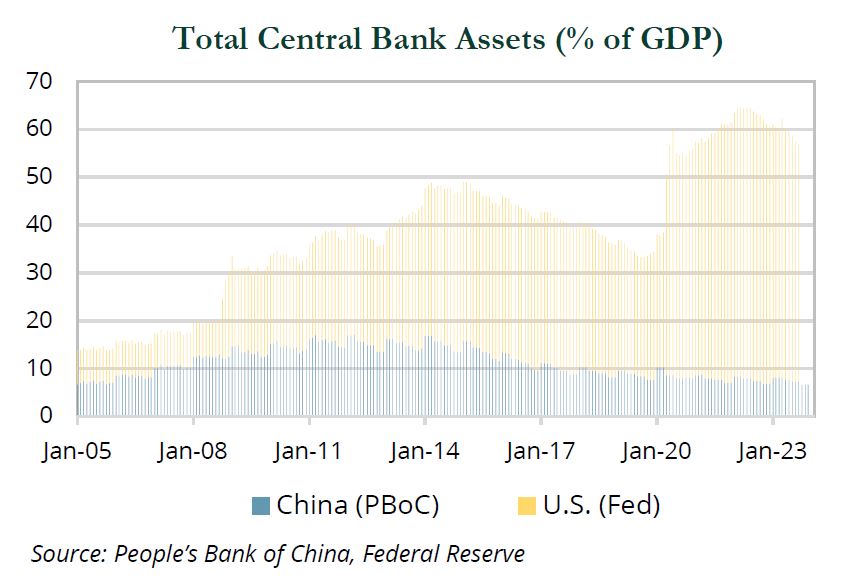

Attention has turned to Beijing, the People’s Bank of China (PBoC), and the support it will offer to a flagging economy. Unlike other nations, China provided little in financial aid during the pandemic. Beijing has taken a cautious approach to policy support, with incremental moves aimed at shoring up the housing sector, stabilizing capital markets, and boosting consumer spending. So far, these efforts have fallen short of investors’ hopes.

Beijing has the flexibility to offer greater support. Its reluctance to offer financial relief during COVID leaves room to expand the balance sheet. Increased intervention in the real estate market and direct consumer support—likely in the form of vouchers and subsidies—seem like viable options to spark the economy.

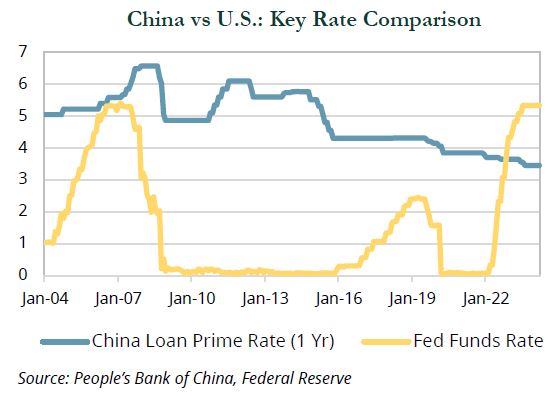

The PBoC also has room to cut rates without fear of spurring inflation; however, it remains sensitive to the stability of the yuan. China’s currency has fallen approximately 5% vs. the U.S. dollar over the past year. More significant PBoC intervention could lead to continued depreciation, particularly if rate cuts in the U.S. are delayed further.

Policy support has increased as of late, but it remains to be seen if Beijing is willing to devote the amount necessary for the economy to regain its footing.

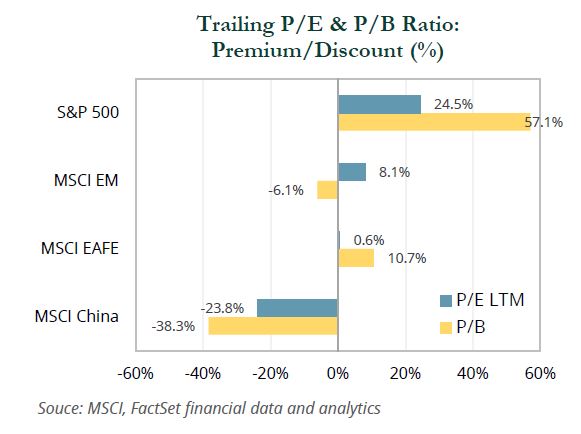

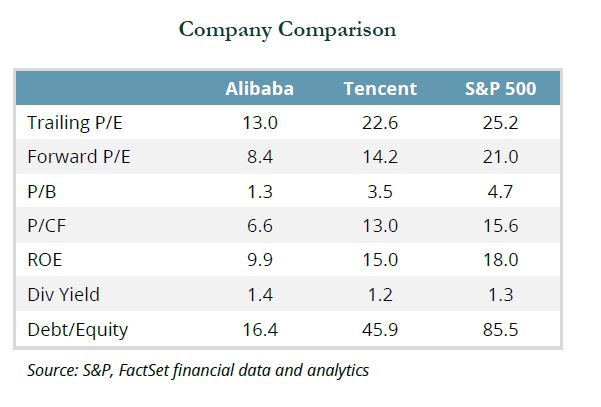

China’s recent market decline rivals that of the U.S. during the Great Financial Crisis, but its economic woes seem mild in comparison. The result is an attractive value proposition for Chinese stocks, which not only trade at a significant discount to their own averages, but also 26% and 30% discounts on P/E and P/B, respectively, compared to the MSCI EM Index as of March 31, 2024. Some discount compared to other markets is warranted, given China’s risk profile and a relative lack of transparency into country and corporate data, but current levels appear excessive.

These valuations are not necessarily reflective of underlying fundamentals. Earnings per share (EPS) growth for the MSCI China Index has trended upward since November 2022, albeit off a low base. Manufacturing activity hit a 13-month high in March 2024, capping five consecutive months of expansion for the first time in nearly three years. Export and services data have also shown improvement in 2024.

The disconnect between valuations and fundamentals is best illustrated in China’s largest companies, Tencent and Alibaba. These names tend to be most impacted by sentiment, as the largest benchmark constituents, and trade at a significant discount to the S&P 500, despite offering comparable quality characteristics.

Road to Nowhere

The authoritarian nature of the Chinese Communist Party affords Beijing more power than most governments. Just as sound leadership could drive a recovery, more bungled policy could send the economy spiraling further. President Xi’s efforts to consolidate power, and his preference for loyalty over competence, call into question the quality of guidance offered by his inner circle. Though there have been improvements as of late, Xi has done little thus far to instill confidence in his ability to handle the economy going forward.

Geopolitical risks remain at the forefront of investors’ minds. The most notable risks include:

- Taiwan – Xi has made his intention to unify Taiwan clear. While direct military intervention seems unlikely, it cannot be ruled out, and the economic consequences would be severe.

- S. – Increased rhetoric and tensions are likely heading into the U.S. election. Former President Trump has already gone on record with his desire to bring back more severe import tariffs if elected. De-risking and strategic competition, regardless of U.S. leadership, will carry on for the foreseeable future.

- South China Sea – China has steadily increased its military presence in the region, increasing tensions with its neighbors.

- Russia – The “no-limits partnership” between China and Russia escalated tensions with the West. However, there are clearly limits to the relationship, as Xi has distanced himself from the invasion of Ukraine.

From an economic perspective, China is far from out of the woods. Youth unemployment remains stubbornly high. Weak domestic demand has fueled concerns over deflation. Longer-term, population demographics will continue to deteriorate, and rising local government debt will need to be addressed.

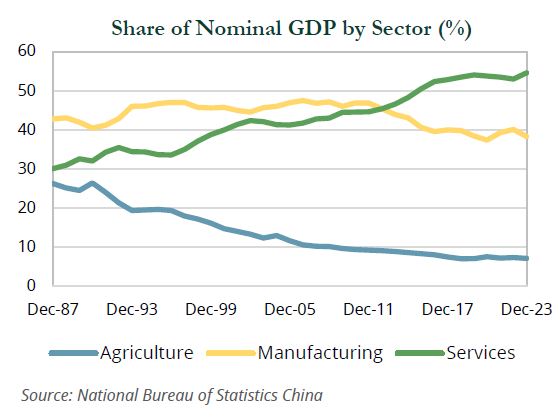

China also faces the daunting task of transitioning its growth model. Its ascent was supported by two pillars, investment and exports. Both have become victims of China’s success, as the country built out its infrastructure and labor costs increased. With manufacturing dominance already waning, geopolitical tensions accelerated the process of nearshoring. For its next leg of growth, China needs to boost domestic consumption, services, and innovation. This phase of growth is more challenging, and doing so risks eroding its competitiveness as an exporter.

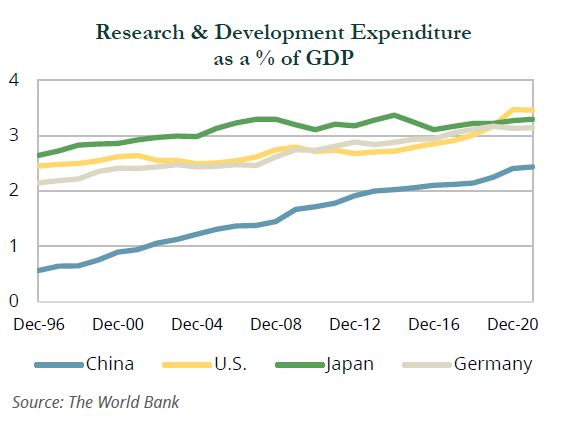

Since taking office in 2012, Xi has sought to usher in a new era of higher quality, more sustainable economic growth. Innovation in the tech sector has been at the forefront of these efforts. There has been progress to date, but it remains to be seen if the country can escape the middle-income trap that ensnared other emerging economies in the past.

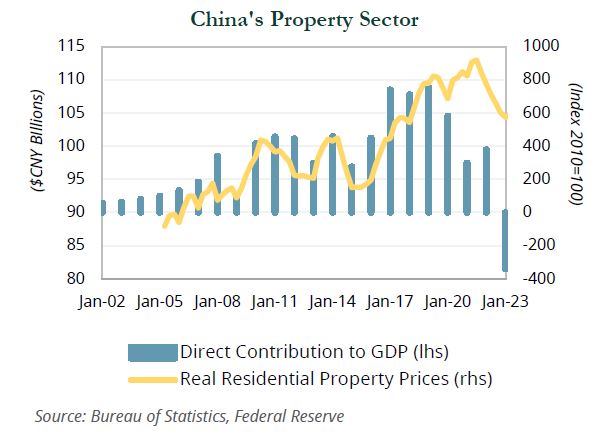

The fate of China’s economy is inextricably linked to its beleaguered housing market. Not only has property development been a key driver of growth, but roughly 70% of China’s household wealth is invested in property. This puts Beijing in the precarious position of trying to cool what had been an overheating property market without causing a drop in housing prices. These efforts have been unsuccessful thus far. Without sufficient government support, stress in the property market could accelerate.

The Road Ahead

Predicting the success or failure of any market is nigh on impossible. In China, it is complicated further by the mercurial nature of its leadership. Since taking office, President Xi has simultaneously pursued economic modernization and Maoist ideology and political control. These goals are in conflict with one another and have resulted in contradictory policies that have confounded consumers and investors.

Investors are left to balance the prospect of a potentially significant re-rating, should China recover, with an elevated risk profile. Some have been tempted to divest from China, given present uncertainty, but ignoring a market of such size and importance brings its own risks. China is the second largest economy in the world by GDP, and for all the talk of decoupling, China remains intertwined in the global supply chain, and will likely remain the largest actor in global trade for the foreseeable future. China remains the largest constituent in the MSCI EM Index at 25.1%. However, it is significantly smaller in the MSCI ACWI Index (2.1%), roughly half the size of the size of the largest benchmark constituent (Microsoft) .

Investors face a confluence of economic, political and geopolitical challenges in China that need to be navigated. An active investment approach offers a chance to capitalize on attractive opportunities when presented, while potentially avoiding the most vulnerable segments of the market. ■

RYAN FANNING

Principal/Senior Director, Research – Equity

Indices referenced are unmanaged and cannot be invested in directly. Index returns do not reflect any investment management fees or transaction expenses. All commentary contained within is the opinion of Prime Buchholz and is intended for informational purposes only; it does not constitute an offer, nor does it invite anyone to make an offer, to buy or sell securities. The content of this report is current as of the date indicated and is subject to change without notice. It does not take into account the specific investment objectives, financial situations, or needs of individual or institutional investors. Some statements in this report that are not historical facts are forward-looking statements based on current expectations of future events and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Information obtained from third-party sources is believed to be reliable; however, the accuracy of the data is not guaranteed and may not have been independently verified. Performance returns are provided by third-party data sources. Past performance is not an indication of future results.© 2024 Prime Buchholz LLC