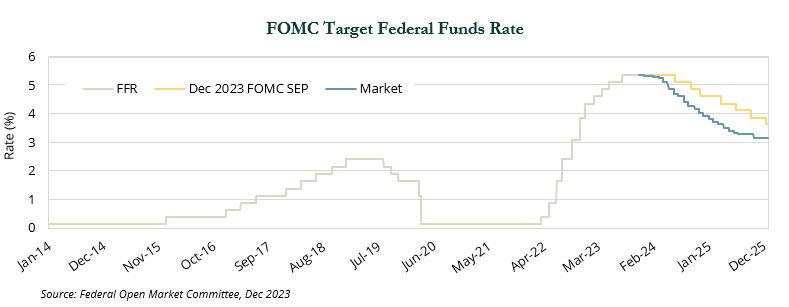

The Federal Open Markets Committee (FOMC) last hiked rates in July 2023, bringing the federal funds rate to 5.25-5.50%. While rates were held steady at the September, November, and December meetings, the Fed retained the option to adjust rates if needed. However, the Summary of Economic Projections (SEP) penciled in three rate cuts in 2024.

The Federal Open Markets Committee (FOMC) last hiked rates in July 2023, bringing the federal funds rate to 5.25-5.50%. While rates were held steady at the September, November, and December meetings, the Fed retained the option to adjust rates if needed. However, the Summary of Economic Projections (SEP) penciled in three rate cuts in 2024.

Current positioning of the federal funds rate futures market indicates that investors believe the Fed will cut rates five or six times in 2024, beginning in March. The market’s expectation for the pace of the rate cuts is inconsistent with the most recent SEP, as well as the Fed’s guidance of holding rates “higher for longer.

In this investment perspective, we evaluate the current environment through the lens of the Fed’s dual mandate and attempt to reconcile the start date of when the easing cycle may begin.

Current Macro Environment

Since 1977, the Fed has operated under a mandate from Congress to “promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.” To understand the possible direction of monetary policy over the coming year, we need to examine the status of labor markets and inflation.

Labor Markets

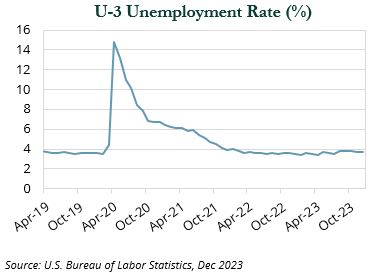

Several government data sources—weekly unemployment insurance claims, the Job Openings Labor Turnover Survey, and the Employment Situation report—indicate a relatively healthy labor market. These metrics suggest the job market has remained remarkably resilient in the face of 525 bps of rate hikes from March 2022 to July 2023.

While the reported numbers do not provide a comprehensive picture of the labor market, and some would claim they understate the issues, the majority of well-regarded labor metrics indicate a fairly healthy labor market.

Stable Prices

In 2020, following years of below-target inflation, the Fed adopted a target of 2% average inflation rate over the long-term. The combined fiscal and monetary policy response to combat the pandemic saved the U.S. economy from entering a deep and painful recession.

Following this period price inflation began to meaningfully rise in 2021. Inflation continued in 2022, with headline inflation ultimately reaching a peak of 9.1% in June 2022. Core inflation (CPI, less volatile food and energy prices) peaked at 6.6% in September 2022.

From March 2022 until July 2023, the Fed hiked rates by 525 bps, in an effort to combat inflation—the sharpest tightening cycle in a generation.

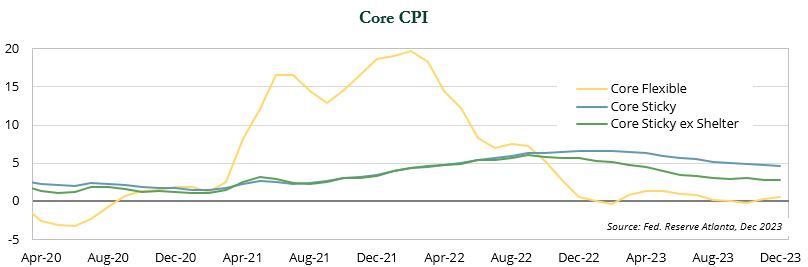

The chart below shows that much of the early declines in core inflation came from what the Atlanta Fed calls “flexible inflation,” which is largely goods-related inflation. Consumers shifting purchases from goods to services, along with improvements in supply chains, helped goods inflation to fall.

Services inflation, which the Atlanta Fed largely labels “sticky inflation” because it adjusts less frequently than the flexible category, is more influenced by factors such as wages and shelter. Sticky inflation has moderated, but much more slowly than the change in goods inflation.

What’s Next ?

Inflation remains above target. The general view among the FOMC is that more rate hikes are unlikely. Instead, maintaining restrictive levels for an extended period is likely to keep inflation moving towards the 2% target, according to the Committee.

As the following chart demonstrates, there is a disconnect between the Fed’s guidance over the next two years and the market’s expectations. While these types of disconnects have occurred in the past, the timing and pace of expected rate cuts is very different from the Fed’s projections.

The Fed seems to be pricing in three “calibration cuts” to lower rates as inflation falls, so they will not be too restrictive. Data suggest the market believes inflation will either come down faster than the Fed expects or the economy will need more support. Whatever the case, the market is pricing in five to six rate cuts this year.

There is also a disagreement about how close we are to the start of an easing cycle. Historically, the pause between the last hike and first cut has lasted between six and nine months, on average. Markets have gradually pulled back from the expectation that the easing cycle will begin in March 2024. Current data suggests that the market believes, with high probability, that the cycle will start in May of this year. This falls just outside of the normal range, and may or may not be consistent with the Fed’s “higher for longer” guidance.

An early—and perhaps more aggressive—easing cycle than the one envisioned by the Fed hinges on a broad view that a soft landing is not guaranteed.

Arguments in favor of the market’s expectation include the following:

- “The Fed pivoted in December” has become a popular notion recently, that many feel eliminates the idea of “higher for longer” and opens the door for policy easing.

- Business investment remains low as companies grapple with higher borrowing costs that place the burden of economic growth more on the consumer.

- The consumer could feel additional strain, hampering spending. Reasons cited include rising credit card delinquencies, the resumption of student loan payments, and slowing wage growth.

- Past rate hikes are only starting to impact the real economy.

- Corporate stress may lead to defaults and/or bankruptcies, which puts the labor market at risk of a retrenchment.

Those arguing for a patient Fed note that:

- Inflation remains elevated and could be stickier than expected.

- Much of the next leg down has to come from “slower moving” categories, such as shelter.

- Geopolitical risks, including the Russia/Ukraine war and Middle East tensions, could impact food and energy prices, transportation costs, etc.

- The two most important global shipping lanes—

the Panama Canal and the Suez Canal—are currently experiencing crises that are reducing the throughput of both channels, creating delays and increasing shipping costs.

REPORT BY ROBERT KIZIK

REPORT BY ROBERT KIZIK

Principal/Sr. Director, Research

Indices referenced are unmanaged and cannot be invested in directly. Index returns do not reflect any investment management fees or transaction expenses. All commentary contained within is the opinion of Prime Buchholz and is intended for informational purposes only; it does not constitute an offer, nor does it invite anyone to make an offer, to buy or sell securities. The content of this report is current as of the date indicated and is subject to change without notice. It does not take into account the specific investment objectives, financial situations, or needs of individual or institutional investors. Some statements in this report that are not historical facts are forward-looking statements based on current expectations of future events and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Information obtained from third-party sources is believed to be reliable; however, the accuracy of the data is not guaranteed and may not have been independently verified. Performance returns are provided by third-party data sources. Past performance is not an indication of future results.© 2023 Prime Buchholz LLC