Education, Perspectives

Unraveling OCIO Solutions: A Guide for Investors

Dec 14, 2023

Back to all posts.The outsourced chief investment officer (OCIO) industry has grown rapidly in recent years. Adoption of the OCIO model was initially dominated by pension plans; however, the rest of the nonprofit world is now increasingly looking to OCIO providers to help navigate the multitude of difficult market conditions and governance challenges impacting investors:

Market Volatility – Ongoing geopolitical tensions, inflation fears, and economic uncertainty cause markets to fluctuate at extreme levels.

Complexity – A diversified portfolio requires coverage of more asset classes, which grow in volume and complexity continuously.

Operational Burden – Growing administrative requirements place a heavy burden on staff, pulling them away from other responsibilities.

Governance Demands – Greater complexity means greater need for oversight and the ability to manage risk and effectively rebalance.

Technological Advancements – Rapidly advancing analytical tools that help monitor portfolio activity and manage risks are of growing importance and can be cost-prohibitive.

Regulatory Environment – There is greater scrutiny and requirements from regulators to ensure institutions are meeting their fiduciary duties.

Costs – The costs to employ experts that cover all a sset classes and areas of the market are considerable.

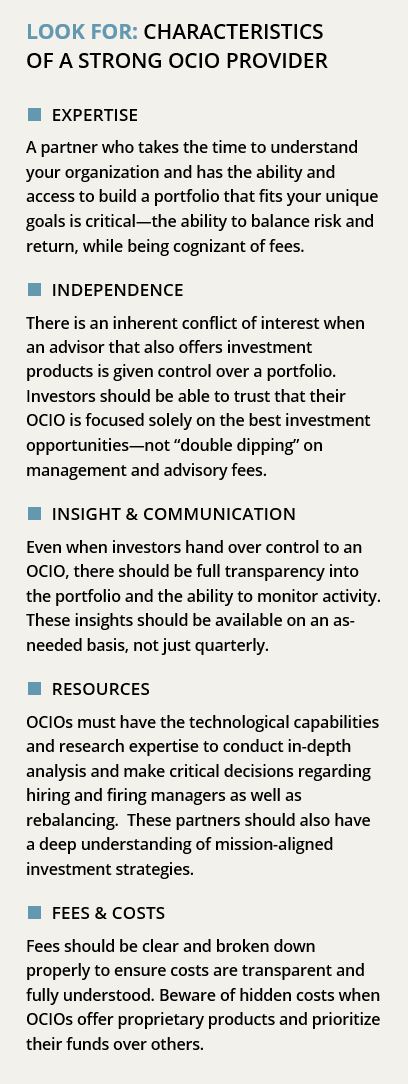

While the largest OCIO providers continue to grow and consume smaller discretionary shops, it is critical that investors remain attentive when selecting an advisor.

In this report, we will examine the industry trends and market conditions that have led to this growth, and offer solutions for investors considering discretionary investment advisory service models.

Current Environment

Investors navigating today’s dynamic landscape often consider the OCIO model for its adaptability to the evolving market environment. The model offers compelling solutions to a wide variety of investors due to the efficiencies they offer, cost savings, access to specialized expertise, and ability to adapt to market fluctuations and evolving investor demands.

Concerns regarding inflation, economic uncertainty, and unpredictable geopolitical shifts have heightened the need for diversified portfolios and sophisticated risk management strategies. A prolonged environment of low and stable bond rates, combined with low equity volatility, favored simpler approaches and allowed stock/bond blends to generate strong returns. We believe a higher rate environment changes relationships between assets and affords greater potential for value-add through portfolio construction and implementation.

The ability to navigate a sophisticated portfolio through various market disruptions while managing risk and keeping an eye out for new opportunities is more critical than ever before. Some OCIOs offer customized solutions and the flexibility to tailor their approaches to suit the unique requirements of each investor. This level of adaptability helps ensure that client portfolios remain resilient and focused on their long-term objectives.

The ever-expanding investment manager universe makes it critical that OCIOs provide access to top-tier managers. Investors should seek “right sized” partners that are small enough to be nimble, but large enough to matter to top-tier managers. OCIOs should be able to use their scale to obtain favorable fees, which then get passed on to clients.

Technological advancements also play a pivotal role. OCIOs use a variety of analytical tools and data sources to inform decision-making and gain insights into emerging market trends. This integration allows for dynamic adjustments to investment strategies, enhancing performance and risk management. For many institutions, outsourcing investment management eliminates the need for extensive in-house teams and expensive software, resulting in meaningful reductions in operational costs.

While the current landscape makes the case for a strong OCIO, selecting the best provider can be challenging. The OCIO universe has expanded exponentially in the past few years, topping 100 providers. The list is top heavy, with more than half of total global assets managed by seven large multi-functional financial institutions, most focused on large pensions. The recent transfer of Vanguard’s OCIO business to Mercer further concentrates it. With so many players involved, a clearly defined set of criteria is critical to selecting an OCIO.

How We Can Help

Prime Buchholz has been working with institutional nonprofit clients for more than 35 years. We built our business by understanding clients and sitting on the same side of the table as their trusted investment advisor. Each client, and thus each portfolio, is unique and tailored to the client’s specific goals, mission, and financial circumstances.

Prime Buchholz has been working with institutional nonprofit clients for more than 35 years. We built our business by understanding clients and sitting on the same side of the table as their trusted investment advisor. Each client, and thus each portfolio, is unique and tailored to the client’s specific goals, mission, and financial circumstances.

Versatility is a hallmark of our approach. We have the ability and expertise to understand and manage the challenges of market conditions as well as the core value of adapting to meet our clients’ needs. We evolved into an OCIO provider naturally, as we extended the services we already provided to approximately 250 clients.

Our current services range from non-discretionary consulting to discretionary OCIO models. Many of our clients opt for a hybrid solution that allows them to fully customize their approach, and delegate or resume control as their needs change.

Advantages of Working with Prime Buchholz

- Long history; deep staff of experts

- Independent; avoid business conflicts of many of our competitors

- Alignment of Interests

- Deep and experienced internal research team

- 100% employee-owned

- Quality manager access

- Built for you; no model portfolios

- Strong back office capabilities

- Extensive MAI & DEI expertise

- Industry-leading proprietary reporting and analytics platform

Our deep staff of industry experts works with clients to identify solutions that are designed to achieve their missions and goals. Moreover, our independence helps assure that your mission and our mission are one and the same.

Conclusion

The OCIO industry has surged in popularity in recent years, attracting diverse investors amidst market complexities. The challenging investment landscape of the last half decade has amplified the need for a steady hand and trusted guide at the helm.

In addition to more than three decades of experience and specialized expertise, Prime Buchholz offers an optimum blend of flexible service models, a deep understanding of the non-profit world, an aligned, independent ownership structure, and unique insights gained through our proprietary analytics platform.

WRITTEN BY IAN MACPHERSON — Principal/Consultant

Copyright MSCI 2023. Unpublished. All Rights Reserved. This information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. This information is provided on an “as is” basis and the user of this information assumes the entire risk of any use it may make or permit to be made of this information. Neither MSCI, any of its affiliates or any other person involved in or related to compiling, computing or creating this information makes any express or implied warranties or representations with respect to such information or the results to be obtained by the use thereof, and MSCI, its affiliates and each such other person hereby expressly disclaim all warranties (including, without limitation, all warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any other person involved in or related to compiling, computing or creating this information have any liability for any direct, indirect, special, incidental, punitive, consequential or any other damages (including, without limitation, lost profits) even if notified of, or if it might otherwise have anticipated, the possibility of such damages. FTSE International Limited (“FTSE”) © FTSE 2023. FTSE® is a trade mark of the London Stock Exchange Group companies and Is used by FTSE under license. All rights in the FTSE indices and / or FTSE ratings vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions In the FTSE indices and / or FTSE ratings or underlying data. No further distribution of FTSE Data is permitted without FTSE’s express written consent.” Notes: Specialty REITs include data centers, outdoor advertising, casinos, farmland, and other sectors. Diversified REITs contain some companies that own office space. On a look-through basis this is estimated at 3% of the index. SFR represents single family for rent and MF represents manufactured housing. © Copyright 2023 Cambridge Associates. All Rights Reserved. Note: Data is continuously updated and therefore subject to change. All commentary contained within is the opinion of Prime Buchholz and is intended for informational purposes only; it does not constitute an offer, nor does it invite anyone to make an offer, to buy or sell securities. The content of this report is current as of the date indicated and is subject to change without notice. It does not take into account the specific investment objectives, financial situations, or needs of individual or institutional investors. Information obtained from third-party sources is believed to be reliable; however, the accuracy of the data is not guaranteed and may not have been independently verified. Performance returns are provided by third-party data sources. Some statements in this report that are not historical facts are forward-looking statements based on current expectations of future events and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Past performance is not an indication of future results. © 2023 Prime Buchholz LLC