Perspectives

Investment Perspective: Commercial Real Estate – Where Do We Go From Here?

Nov 9, 2023

Back to all posts.Stress & Distress

A steady stream of headlines highlighting distressed CRE assets and landlords paint a grim outlook for the asset class.

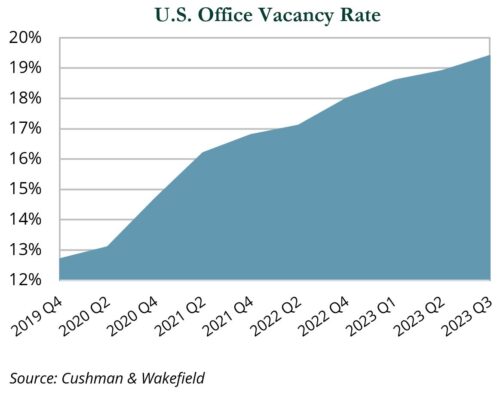

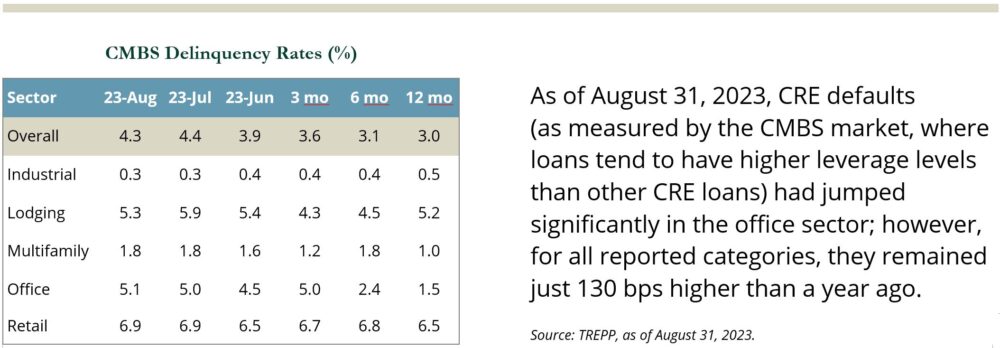

Stress and distress emerged in the office space sector, as post-pandemic work-from-home trends have altered the demand for office space, resulting in climbing vacancy rates. This has dislocated the sector and initiated a rationalization of historic values. Additionally, with a sharp increase in interest rates and lower debt availability, office loan delinquency rates have moved higher.

Certain assets in other sectors, notably apartments, bought at peak pricing and saddled with higher levels of floating rate debt (where interest rate caps are expiring), are also showing signs of stress and distress.

We believe there are real reasons for concern. However, the outlook for CRE, which is the world’s largest asset class, is more nuanced, and turbulence in CRE has the potential to create opportunities in both the private and public markets.

Highly Diverse Asset Class

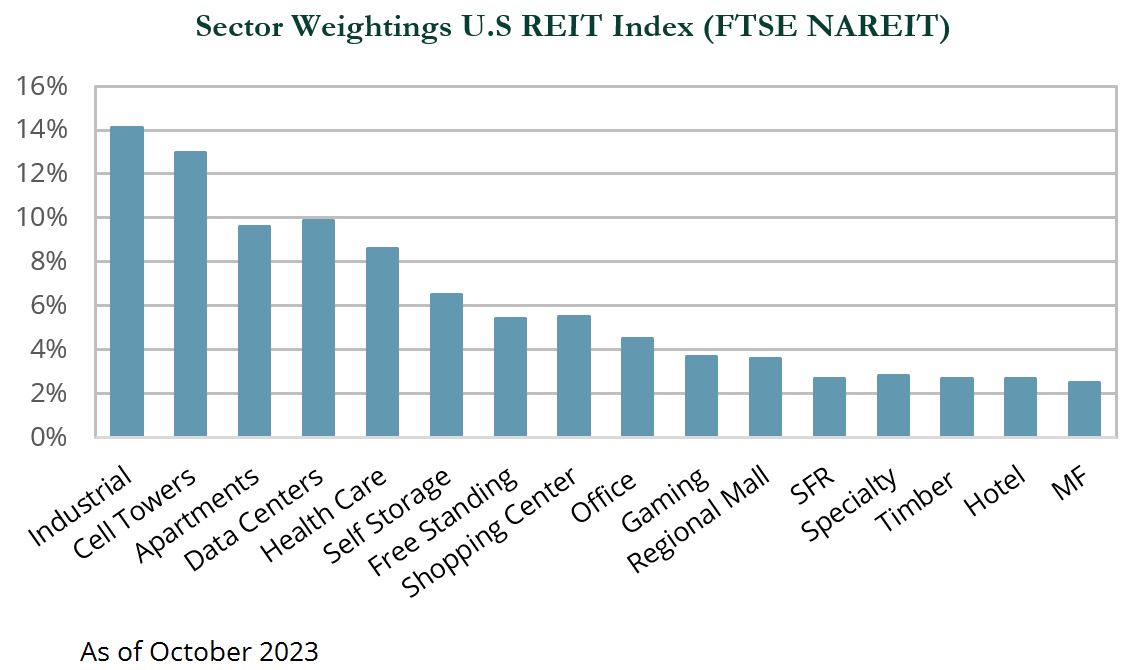

CRE is highly diverse, comprising more than a dozen sectors with disparate demand drivers, growth trends, economic and interest rate sensitivities, pricing power, and lease durations, totaling an estimated $20.7 trillion total market capitalization in the U.S. alone, as of June 30, 2021, according to NAREIT.

While some headlines have seemed to equate CRE with the office sector, the office sector is an increasingly smaller part of the large and varied CRE market, accounting for approximately $3.2 trillion—or 5% of the market as of mid-year 2021, according to NAREIT.

Sectors like industrial, single-family for-rent, self-storage, and data centers have continued to benefit operationally from growing rents and strong secular and demographic tailwinds.

Further, assets and borrowers experiencing short-term stress or liquidity needs may be aided by guidance from regulators. The OCC, FDIC, NCUA, and Federal Reserve in June 2023 issued new guidance on real estate loan accommodations, encouraging short-term agreements that provide relief to a borrower experiencing a financial challenge.

Public & Private Markets

The speed and magnitude of the rise in interest rates resulted in valuation declines in public REITs in 2022 and year-to-date through the end of September 2023.

Historically, public REITs have tended to overshoot to the upside and the downside relative to private real estate. Private valuations lag public markets and may continue to experience declines in the quarters to come, given the material increase in interest rates and diminished debt availability. Sectors such as office space appear most susceptible to steeper declines.

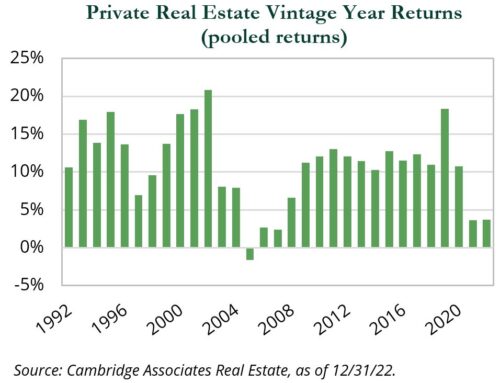

Older vintage funds (2014 – 2016) have historically had higher traditional office exposure, as well as some retail exposure. In recent years, however, private strategies have tended to invest less in the office sector, in favor of sectors with stronger secular tailwinds.

Debt Maturities & Tighter Credit

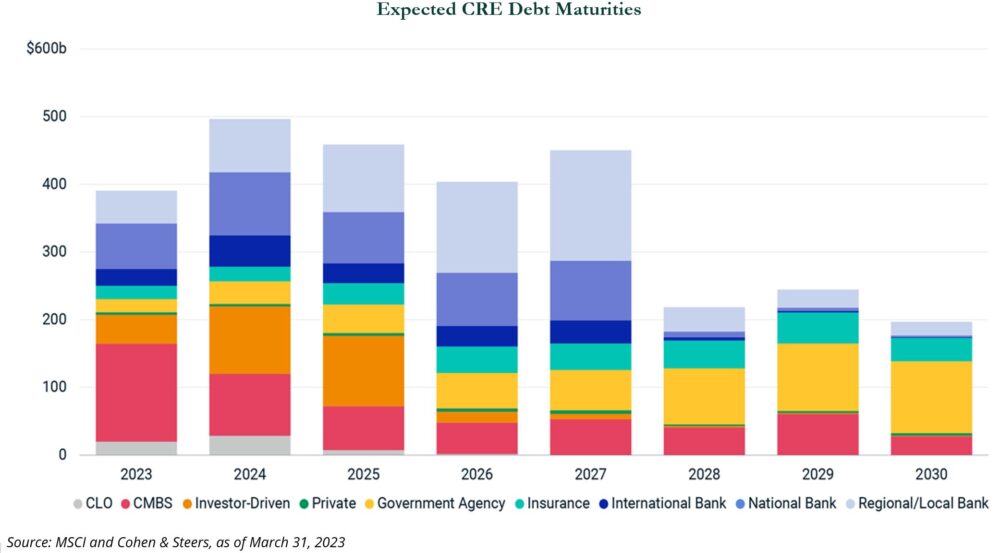

The U.S. CRE mortgage market represents $4.9 trillion as of year-end 2022, with significant annual maturities expected in 2024 (approximately $500 billion) and beyond.

The banking crisis that occurred early in 2023, along with a pronounced pullback in lending from regional banks, has amplified concern in the real estate industry.

Banks play a significant role in financing the industry, accounting for 45% of all outstanding CRE mortgages. There is concern that tighter underwriting standards by, and less capital availability from, stressed regional banks, as well as higher rates, could put additional pressure on the CRE industry, with significant debt maturities set to occur in 2024 and 2025.

Troubled CRE loans could further stress regional banks, reducing office values even more. Additionally, this could strain local or state governments that rely on property taxes and real estate-related revenues.

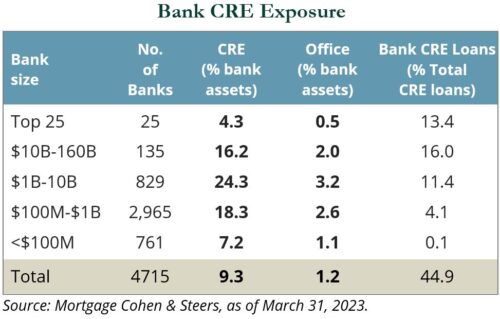

CRE represents a meaningful percentage of bank assets, particularly midsize banks of $1–10 billion in assets, however CRE office loans remain only a small portion of bank assets.

If regional banks stay on the sidelines for a significant period of time, life insurance companies, agencies, and private credit may step in to fill part of the gap in available credit. While life insurance companies and agencies provide pricing that may be as attractive as banks, private credit lenders typically require higher yields than banks.

Some fixed income managers with CMBS exposure have reported maintaining positions in high conviction ideas, while paring back deals that they believe may have early signs of stress. Managers have also reported engaging in opportunistic buying in the office sector, as the many concerns over the sector’s outlook have created what some managers consider relative value opportunities.

Short-Term Outlook

Tighter lending standards and higher-for-longer rates are likely to result in increased stress and distress in the office sector, and other sectors where leverage and the current owner’s cost basis is high.

Private valuations for existing funds may continue to experience declines in the quarters to come. New development starts have declined, which could result in limited new supply a year from now. Depending upon demand levels, this could set the stage for stronger fundamentals in a number of sectors.

Opportunities

The decline in REIT valuations over the trailing 18 months may make for attractive entry points in the future. We believe measured rebalancing can be a prudent way to capture cyclical returns in the space.

A down cycle, combined with stress in the industry amongst higher-levered asset owners, could create significant opportunity for value-add private real estate funds.

- Historically many of the best vintage private real estate funds have emerged from periods of stress/market down cycles and we believe investors should make consistent vintage year commitments to the sector.

- Private value-add and opportunistic real estate funds will likely seek to acquire high quality assets which have poor/distressed capital structures (i.e. too much floating rate debt).

- Many of these groups also have experience investing in distressed debt, originating new loans and making preferred equity investments during market downturns, when these opportunities meet their return targets.

Medium & Long-Term Outlook

The future of the office sector is likely to remain uncertain for some time, and may play out similar to the retail sector’s path after it was first disrupted in the 2015 – 2016 period. Over-levered assets in other sectors may also experience an extended period of stress. Despite the potential for ongoing turbulence, the prospects for many sectors appear robust, given favorable secular dynamics. Favorable trends for certain sectors include:

- Housing continues to be chronically under-supplied, and home ownership is increasingly out of reach for many Americans, driving demand for a variety of rental housing.

- Industrial demand continues to grow with further ecommerce penetration, faster delivery times and on-shoring trends.

- Self-storage is expected to continue to benefit from growing consumer and business demand, due in part to work from home arrangements and baby boomer downsizing.

- Life science office, senior housing, and medical office sectors are expected to benefit from the aging of baby boomers and an increasing pace of new drug discovery.

- Data centers and towers are expected to accrue benefits from growing data consumption due to the roll out of 5G and growth in AI.

WRITTEN BY JESSE LYNCH — Principal/Senior Director, Research – Real Assets

Copyright MSCI 2023. Unpublished. All Rights Reserved. This information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. This information is provided on an “as is” basis and the user of this information assumes the entire risk of any use it may make or permit to be made of this information. Neither MSCI, any of its affiliates or any other person involved in or related to compiling, computing or creating this information makes any express or implied warranties or representations with respect to such information or the results to be obtained by the use thereof, and MSCI, its affiliates and each such other person hereby expressly disclaim all warranties (including, without limitation, all warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any other person involved in or related to compiling, computing or creating this information have any liability for any direct, indirect, special, incidental, punitive, consequential or any other damages (including, without limitation, lost profits) even if notified of, or if it might otherwise have anticipated, the possibility of such damages. FTSE International Limited (“FTSE”) © FTSE 2023. FTSE® is a trade mark of the London Stock Exchange Group companies and Is used by FTSE under license. All rights in the FTSE indices and / or FTSE ratings vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions In the FTSE indices and / or FTSE ratings or underlying data. No further distribution of FTSE Data is permitted without FTSE’s express written consent.” Notes: Specialty REITs include data centers, outdoor advertising, casinos, farmland, and other sectors. Diversified REITs contain some companies that own office space. On a look-through basis this is estimated at 3% of the index. SFR represents single family for rent and MF represents manufactured housing. © Copyright 2023 Cambridge Associates. All Rights Reserved. Note: Data is continuously updated and therefore subject to change. All commentary contained within is the opinion of Prime Buchholz and is intended for informational purposes only; it does not constitute an offer, nor does it invite anyone to make an offer, to buy or sell securities. The content of this report is current as of the date indicated and is subject to change without notice. It does not take into account the specific investment objectives, financial situations, or needs of individual or institutional investors. Information obtained from third-party sources is believed to be reliable; however, the accuracy of the data is not guaranteed and may not have been independently verified. Performance returns are provided by third-party data sources. Some statements in this report that are not historical facts are forward-looking statements based on current expectations of future events and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Past performance is not an indication of future results. © 2023 Prime Buchholz LLC