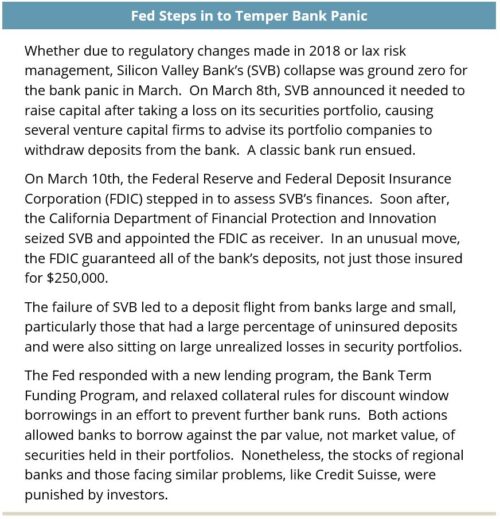

Risk assets were mixed but generally positive during March despite stress in the financial system caused by the collapse of three U.S. banks. Concerns about depository institution solvency first spread among U.S. regional banks and then among major European institutions, particularly in Switzerland. U.S. and Swiss authorities quickly adopted plans aimed at preventing further damage and calming investor fears.

Still, equity market and interest rate volatility spiked during the month. The most notable evidence of banking system concern was the divergence of returns of growth and value stocks. Led by IT gains, growth stocks delivered strong performance while value stocks were weak, driven by financials. Bank stress was also evident in a shift in monetary policy expectations, which led to a fixed income rally. Lastly, these issues impacted near-term inflation expectations, which put pressure on real asset categories.

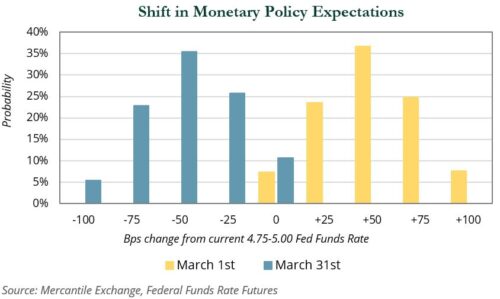

In addition to launching a targeted lending program and allowing easier access to the discount window, the Fed raised rates by 25 bps during the month. Further, the Fed released a dot plot that guided for another rate hike in 2023, while keeping rates steady for the rest of the year. After the tightening cycle concludes, the Fed is generally on hold for six to nine months before an easing cycle begins (see Investment Perspective “Where is Monetary Policy Going?”). However, the market is skeptical. The chart below shows the probability of rate changes implied in the December 2023 federal funds rate futures contract, which seems to indicate investors believe the banking turmoil in March will be the event that causes the Fed to pause the hiking cycle.

There is a popular mantra that “the Fed hikes rates until something breaks.” At the beginning of March, the market believed the Fed was likely to hike rates another 50 bps following the strong nonfarm payroll and inflation report in February. By the end of March, the market was pricing in 50 bps of rate cuts in 2023 on the belief that financial conditions had meaningfully tightened

A potential shift in Fed policy outweighed concerns about banks for U.S. equity markets as the S&P 500 advanced 3.7% and the broader Russell 3000 Index gained 2.7%. While the broad market finished in positive territory, dispersion between market segments was extreme.

Unsurprisingly, financials (-10.0%) was the worst performing segment due to the sharp selloff of bank stocks (-19.0%). At the other end of the spectrum, the IT (+9.8%) and communication services (+9.7%) sectors posted strong gains. Investors once again sought refuge in mega cap tech names, with Microsoft (+15.6%), Alphabet (+15.2%), and Apple (+11.9%) generating double-digit returns. With FAANGMs back in favor, large caps significantly outpaced small caps; the Russell 1000 Index gained 3.2% versus a 4.8% drawdown for the Russell 2000 Index. As previously noted, growth stocks materially outperformed value, with the Russell 3000 Growth Index advancing 6.2% versus a 0.9% decline for the Value Index.

Foreign markets were not immune to the turmoil caused by U.S. regional banks. The stock of financials companies across the world declined in the fallout of SVB’s failure, but it was Credit Suisse (−70.4%) that came under the greatest pressure. After years of scandal and self-inflicted wounds, the Swiss company was a primary target for investors looking to pull capital, culminating in a government-brokered sale to long-time rival UBS (−3.3%). The 18.8% decline of Deutsche Bank indicated investor panic was more focused on reputation than fundamentals. The bank suffered a number of missteps last decade, but was in the midst of a successful restructuring that saw $7.6 billion in net profit in 2022. Non-U.S. banks on the whole fell over 8% for the month.

Despite the negative headlines and sentiment, the MSCI EAFE Index rose 2.5% as returns outside of financials were generally positive. Traditional growth segments of the market, such as technology (+8.4%) and luxury goods (+9.1%), saw the strongest gains, helped by speculation that the pace of global tightening would slow in response to the shock to the global financial system. A more dovish tone from the Fed contributed to weakness in the U.S. dollar, which in turn bolstered returns by approximately 200 bps for U.S.-based investors. The British pound (+2.1%) and euro (+2.4%)—regions where further tightening is expected—saw notable gains on the greenback.

In response to the potential shift in Fed policy, yields fell across the curve and caused a bullish steepening as front-end yields fell faster than longer-term yields. Two- and five-year Treasury yields fell 74 bps and 56 bps compared to declines of 43 bps and 24 bps for 10- and 30-year Treasuries, respectively. The 2s10s spread remained inverted but steepened 31 bps. The 5s30s spread increased 32 bps, moving the spread into positive territory. These changes led to low- to mid-single-digit returns across the maturity spectrum with longer-dated Treasuries outperforming both their intermediate-term and short-term counterparts.

Credit spreads rose during the month. Investment-grade corporate spreads rose 16 bps to 138 bps; the financial sector hit a high of 198 bps on March 15th before finishing the month at 174 bps. March has historically been a strong month for investment-grade corporate issuance, but instability in the banking system resulted in lower than expected bond issuance. High yield spreads experienced similar intra-month volatility and finished the month up 43 bps to 455 bps. Despite the concerns surrounding the banking system, the spread widening in March was more a function of falling interest rates than an increase in credit stress in the market. As a result of falling interest rates, corporates delivered positive returns with investment-grade returns outpacing returns in high yield credits. Bank loans, which have performed well during the current tightening cycle, modestly declined as the market repriced its expectation for further Fed moves.

Most real assets posted negative returns for the month. REITs declined by 4.5% on concerns that a recession would reduce demand for space and that the banking crisis would lead to tighter lending conditions for the commercial real estate sector. Investor concerns appeared to center around the impact of reduced credit availability from bank lenders on sectors such as office and to a lesser extent retail, which have struggled in recent years. It is notable that REIT and private real estate office sector exposure has declined substantially in the past decade with office representing just 6.7% of the MSCI US REIT Index and 13.1% of the FTSE EPRA Developed NAREIT Index as of the end of 2022.

Elsewhere in real assets, diversified commodities were slightly negative (-0.2%). Precious metals advanced sharply (+9.2%) amidst significant market uncertainty and the banking sector crisis. These gains were offset by declines in energy commodities (-6.9%), led by natural gas, which fell by 11.4% on above average storage levels as an exceptionally mild winter came to a close in the U.S. and Europe. Crude ended the month down 4.3%. Oil prices fell sharply during the first half of the month as the banking crisis unfolded and then staged a sharp rally in the second half as the crisis appeared to stabilize and Chinese demand showed signs of rebounding. Natural resource equities were essentially flat (-0.1%) after a strong rally (+5.8%) in the last week of the month.

Infrastructure stocks advanced 2.4% amidst declining rates that made the sector’s resilient cash flow yields more attractive. Clean energy stocks—a mix of infrastructure like businesses, technology companies, and component manufacturers—advanced 2.7%.