Market Updates, Perspectives

Investment Perspective: The Russian Invasion – One Year Later

Feb 24, 2023

Back to all postsIntroduction

One year ago, Russian armies crossed the Ukraine border, beginning an onslaught of destruction, bloodshed, and displacement.

The world largely rallied to Ukraine’s side, providing funding, military weapons/equipment, and supplies, while imposing an unprecedented level of multilateral economic sanctions against Russia. However, the toll the conflict has taken on Ukraine and, more broadly, Europe, is extensive, with no end in sight.

The human loss and impact on the Ukrainian people is nothing short of horrific. The impact of the war on the communities within Ukraine and the displaced families and loved ones outside the country’s borders is immeasurable. The physical destruction to land and infrastructure has exceeded $1 trillion in damages. Meanwhile, the economic toll of the conflict goes far beyond the borders of Ukraine, impacting all areas of the global economy on some level.

We grieve with Ukrainian people and pray for a swift outcome that maintains Ukraine’s standing as an independent nation. With those sentiments at the forefront, we share this Investment Perspective, which examines the impact of the war on the broader economy, specifically global equity and European energy markets.

Global Equity Market

Russia’s domestic equity market was swiftly closed on February 25, 2022, as global investors raced to pull capital amidst geopolitical uncertainty. With no near-term prospects of reopening, Russian securities were written-down to zero, and ultimately removed from major indexes in the weeks following the invasion to reflect the country’s lack of liquidity and investability.

Western companies with significant assets and operations in Russia quickly either wrote off assets or looked to sell operations to Russian entities, often at significant discounts. Through February 2023, it is estimated that over 1,000 multinational companies have voluntarily reduced operations in Russia beyond sanction requirements. Among the most notable is British Petroleum, which walked away from its 20% stake in Russian oil company Rosneft (resulting in a $25 billion loss), and McDonald’s, which divested its operations to a domestic operator, ending a 32-year presence in the country.

Russia’s largest stock exchange, the Moscow Exchange (MOEX), fell nearly 35.0% before it shut down and its stocks were removed from indices on March 9, 2022. The impact on global equity markets was less severe as Russia represented a small portion of global and emerging markets indices. At the start of 2022, Russia represented only 0.4% of the MSCI All Country World Index and just over 3.0% of the MSCI Emerging Markets Index and cost 30 bps and 273 bps in negative returns for the calendar year, respectively. Russia’s stock market reopened to domestic investors in the weeks following the invasion, but foreign investors remain restricted from trading and left holding illiquid positions.

The MOEX experienced periods of strength during the year. However, it should not be interpreted as a signal the market is functioning properly. Early gains were largely the result of government moves to prop up equity markets. The absence of foreign investors, who held an estimated three-quarters of the free float pre-invasion, has also contributed to artificial stability. As soon as trade restrictions are lifted, foreign investors are expected to exit their investments en masse.

Russia’s market closure reverberated throughout equity and fixed income markets. European equities were hit particularly hard given geographic proximity and dependence on Russia’s energy sector. European equity markets, as measured by the MSCI Europe ex-U.K. Index, dropped 27.5% from the start of the war before hitting a low on September 29th.

Commodity Inflation & European Energy

Russia and Ukraine are among the world’s largest suppliers of commodities, including wheat, fertilizer, various metals, and energy. The war may continue to put upward pressure on certain commodity prices and risk Russia’s long-term status as one of the world’s leading commodity providers.

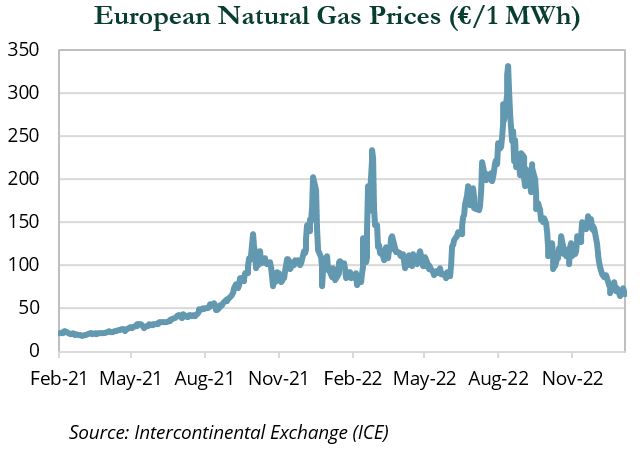

In 2022, trade sanctions contributed to rising global inflation, but perhaps their greatest impact was on energy markets. Russia’s weaponization of energy supplies reshaped global energy markets in 2022 and created an energy crisis across Europe. Prior to the war, Europe imported 40% of its natural gas supply from Russia, but by early summer, Russia was supplying a fraction of that amount. For most of the balance of 2022, this resulted in unprecedented volatility and exceptionally high prices for natural gas, diesel, refined products, and power.

Ahead of the current heating season, markets and governments feared a cold winter could lead to severe energy rationing and a potentially deep recession. Spiking input costs and cuts to production led analysts to slash earnings forecasts.

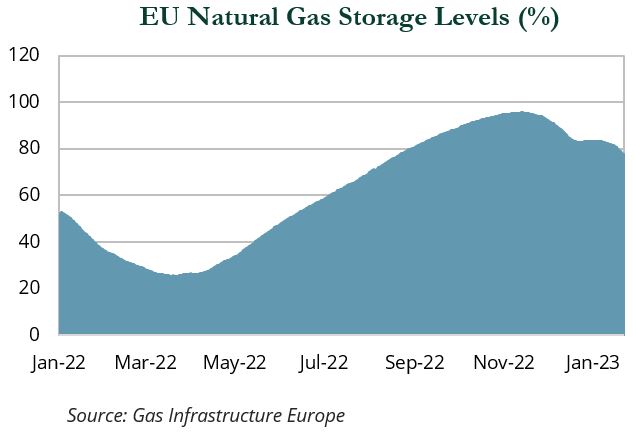

Despite fears that the crisis would intensify, an unusually warm early winter, combined with the aggressive stockpiling of energy resources, has resulted in Europe’s natural gas reserves hovering at 80%—far above the 55% in 2021 and well above the five-year average.

A rapid ramp up in U.S. liquefied natural gas (LNG) exports to Europe has played a key role in Europe’s ability to stockpile energy supplies. European imports of U.S. LNG increased 137% in 2022.

Going forward, U.S. LNG is expected to play an even larger role in Europe’s energy supply, which may serve as a significant boon to U.S. natural gas producers, midstream companies, and LNG operators over the coming decades.

As a result, natural gas prices, and therefore, power prices in most European markets have fallen to below pre-war levels. While it is too early to declare victory—the continent is still only about three quarters of the way through its heating season—Europe has proven adept at adjusting to a reshaped energy landscape and appears to have dodged a worst case economic scenario.

The recession in Europe that appeared inevitable over the summer now seems less likely as falling energy prices and relaxed zero-COVID policies in China have prompted many economists to revise their European outlooks for 2023 from a meaningful contraction to modest growth in GDP.

The war in Ukraine persists with no signs of slowing. If it continues into the winter of 2023-24, it may be very challenging for Europe. Europe will no longer benefit from the volume of Russian natural gas that flowed freely across the region. At the corporate level, some of the moves made by European companies to address the recent energy crunch may prove irreversible, particularly the industrials that closed plants or moved production offshore.

Outlook

Overall, global equity markets were largely shielded from the economic effects of the war due to the broad lack of exposure to Russia. Meanwhile, energy markets appear to have been largely spared by Europe’s ability to adapt to the supply challenges and the mild winter heating season. Given Russia’s status as a key natural resource producer, the potential for long-term inflationary impacts on global energy supplies and other key commodities is a significant risk for the global economy. Further, the implications of a prolonged conflict on the broader economy and markets is a significant unknown at this time.

We join the call of the broader global community for a peaceful end to the war, with Ukraine remaining sovereign and independent. We will continue to evaluate market trends and share insights with clients as necessary. Please feel free to reach out with any questions.