Introduction

Since the term was coined in 2004, the ESG movement—the consideration of environmental, social, and governance factors in the investment process—has overcome numerous challenges to gain traction amongst investors. But just as the movement has taken hold and become part of common investment vernacular, ESG investing now faces a new challenge: the political arena.

Adoption of ESG criteria in investment portfolios has grown rapidly over the last five years. However, in recent months, political leaders in several U.S. states have taken aim at what they describe as “woke capitalism,” targeting one of the world’s largest asset managers, BlackRock, a vocal proponent of sustainable investing.

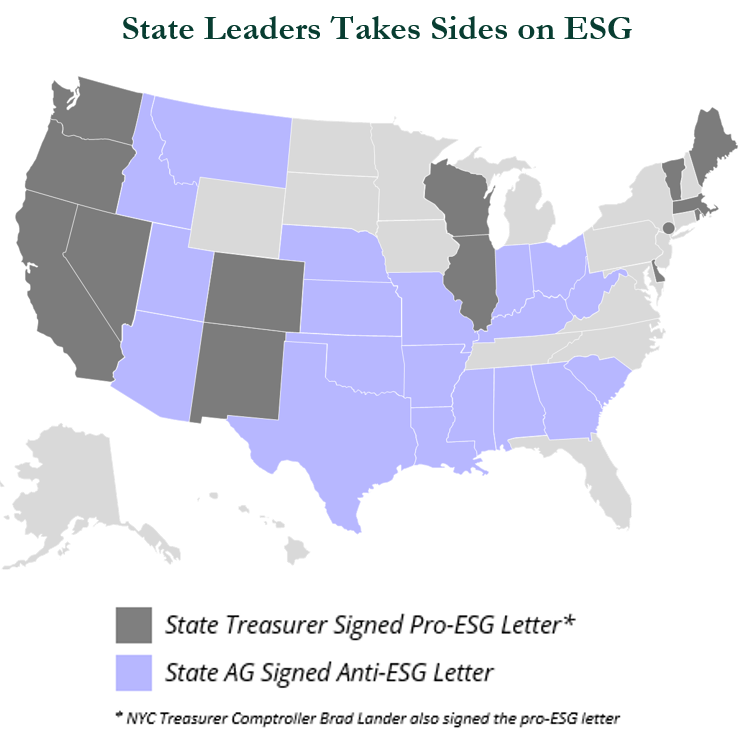

In early August, Arizona Attorney General Mark Brnovich sent a letter to BlackRock on behalf of 19 states, “calling out its practices of putting leftist politics above investors’ interests and returns”[1]. Soon after, Florida Gov. Ron DeSantis adopted a resolution prohibiting the consideration of ESG factors in the state’s investment management practices. Several other states are considering similar actions. Meanwhile, Texas and West Virginia went so far as to blacklist specific financial institutions from new state business for allegedly “boycotting” fossil fuels.

State Leaders Takes Sides on ESG

The combination of a hot energy market helping cool off relative performance of many ESG funds with a series of pro-ESG policy actions by the Biden administration has made the topic of ESG investing a highly politicized subject leading up to the mid-term elections.

In this Investment Perspective, we take a step back to examine the evolution of ESG and—despite the current opposition—the role that ESG investing has in client portfolios.

Anti-ESG Arguments

Performance

As with all investment styles, financial performance of ESG funds ebbs and flows and is highly dependent on the market environment. Comparing an ESG strategy to a more traditionally managed fund over a handpicked timeframe when the energy sector is surging is misleading and ultimately of little consequence to investors with a long-term, risk-adjusted portfolio. The alignment of an investment portfolio with a specific mission is a long-term goal, and therefore, performance should be viewed through a long-term lens.

The rapid growth in popularity of ESG investments has flooded the market with investment products claiming to be ESG, but often with inconsistent and poor transparency. The lack of adequate standards makes it difficult to assess performance with confidence. The financial industry, and the regulatory agencies that govern it, must continue to address the issue of “greenwashing”—the intentional exaggeration or misrepresentation of ESG credentials to attract ESG investors. As the quality of data improves, enhancing transparency and reporting will be critical to combatting greenwashing and addressing the criticism of ESG investments.

Impact

The early days of ESG investing focused primarily on divestment and socially responsible investing (SRI). In the 1980s, activist investors sought to protest events like the Exxon-Valdez oil spill and apartheid by removing exposure to specific companies from investment portfolios. While divesting brought attention to the issue and made investors feel better about where their money was going, the impact was negligible.

ESG investing has evolved far beyond SRI, which—contrary to its prominence in anti-ESG arguments—is only one potential approach within a range of responsible investing approaches. Removing exposure also removes the opportunity for engagement with companies’ management, which can be a catalyst for real change in company behaviors. In fact, engagement is the reason many “big oil” companies and top auto manufacturers are now among the largest investors in clean energy technology.

Third-Party Ratings

While much progress has been made in ESG ratings and standards setting, the industry lacks a globally recognized set of reporting frameworks and benchmarks to clearly define what qualifies as ESG.

Many of the most reputable financial organizations in the world provide detailed assessment and ESG ratings of individual companies. Still, these systems are imperfect, can introduce biases, and may be based on questionable or inconsistent data. Much progress has been made in developing comprehensive standards; however, the consistency and reliability of ratings systems remains a work in progress.

While companies like Tesla may seem to be an ESG company based on their “E” scores, the company often ranks poorly in the “S” and “G” categories. Tesla was actually removed from the S&P 500 ESG Index because of its “lack of a low-carbon strategy” as well as social (poor working conditions) and governance issues. Achieving one component of ESG, no matter how compelling, does not necessarily equate to a strong case for investment.

We do not recommend investing in products based solely on a rating system. In developing a case for ESG investments, we believe scoring systems should be used in conjunction with fundamental research and the ongoing analysis of ESG policies and practices.

Purpose

ESG was largely borne out of investors’ desires to reflect their values in their portfolios. Given that values can vary widely between different types of investors, customizing portfolios to align with specific ESG values is a unique process for each client.

For example, the Christian, Islamic, and Jewish faiths each have well-established investment guidelines that help religious organizations develop portfolios that reflect their views. While the guidelines differ greatly, each can be considered successful frameworks for achievement.

Anti-ESG arguments often focus on failures to achieve broad industry goals. However, the practical application of ESG principles in a portfolio is to build a framework that is specific for the investor and necessitates a unique definition of success.

Politics

While the actions of state leaders have captured headlines, there is little to suggest these assertions reflect the broad views of investors.

In truth, ESG has been the source of political wrangling for some time. In 1994, the Department of Labor (DOL) under the Clinton administration issued guidance that allowed ERISA plan sponsors to incorporate ESG criteria into investment decisions for pension plans. Since then, each new administration (along party lines) has attempted to undo or adjust the actions of the prior administration.

The Biden administration has prioritized several policies that promote ESG factors in the investment industry, including proposed rules by the DOL to adjust ERISA laws and by the SEC to require public companies to disclose climate impact information, including greenhouse gas emissions.

While many organizations, individuals, politicians, and practitioners have suggested changes to the rules, there is widespread support for both. Of the 22,000+ comments submitted on the DOL proposal, 97% supported it[1]. Additionally, 79% of the comments to the SEC on its proposed rule are supportive[2].

The Case for ESG

ESG considerations are often viewed by asset managers as fundamental to the decision process and a key input in the selection of company-level investments. As a result, ESG inputs may be considered a form of risk management whereby sustainable companies have the potential to deliver better long-term risk/return outcomes than companies with weak ESG standards.

- The Environment has been the source of most of the recent consternation, focused primarily on climate change and its causes. The economic impacts of climate change are considerable and wide ranging, threatening significant financial loss across the globe. Worldwide, natural disasters caused $280 billion in total losses in 2021, half of which was from the U.S. alone[3]. The impact of severe weather events and the transition to cleaner energy sources are important considerations.

- Markets have felt the impact of Social movements in recent years, specifically gender and racial equality. The #MeToo campaign that began in 2017 uncovered rampant sexual misconduct at major corporations, costing millions in legal settlements and loss of share value[1]. The Black Lives Matter movement and George Floyd murder brought focus to racial inequality. The widening racial wealth gap is projected to cost the U.S. economy $1–1.5 trillion in lost consumption and investment between 2019 and 2028—equivalent of 4–6% of the projected GDP in 2028[2].

- Governance is an oft-overlooked, but no less critical component of managing investment risk. Poor corporate management and unethical business practices have been directly linked to the collapse of numerous prominent businesses and trillions in losses. Volkswagen’s 2015 emissions scandal cost the company an estimated $34.7 billion[3].

- There is considerable overlap between the social and governance categories and Diversity, Equity & Inclusion. The demand for equality is at the heart of the most significant social uprisings in the last decade, and diverse representation has become a necessity for businesses in all industries—both in term of governance and business practices.

The interconnected nature of these categories cannot be overstated and affects businesses in every industry.

Key Takeaways

The portfolio application of ESG criteria may manifest itself in a variety of ways, ranging from divestment to activism and impact investing. Many actively managed ESG strategies broadly view environmental, social, and governance criteria as fundamental inputs toward identifying sustainable companies that are expected to generate better risk/return outcomes than companies with weak ESG performance. Ultimately, the investors entrusted with protecting and building assets will decide what form ESG investing takes.

Our clients represent a wide range of interests, values, goals, and resources, which is why we seek to create a customized approach for each client. Just as clients set their return objectives or adjust their liquidity, they can choose to consider ESG criteria. Ultimately, clients set their goals; our role is to help get them there.