At Prime Buchholz, Perspectives

SEC Unveils Historic Climate Change Rule

Apr 22, 2022

Back to all postsOverview

When Wisconsin Senator Gaylord Nelson proposed the establishment of Earth Day in 1969, he was responding to a growing grassroots movement to raise awareness about the harm that human behavior was having on the environment. Since then, the day has mobilized more than a billion people annually and built a network of more than 75,000 partners seeking to drive positive action.[1]

More than 50 years in, we are on the precipice of another major milestone, borne out of a grassroots effort, that evolved into a global understanding that climate change is costing the world millions of lives[2] and billions of dollars every year[3]—and that swift and decisive action is needed.

The U.S. Securities and Exchange Commission (SEC) recently unveiled a proposed rule that would require all public companies to disclose a host of climate-related information as part of their annual filings, including details on their greenhouse gas emissions. The SEC is currently accepting public comment on the proposal and expects to finalize the rule later this year.

In this report, we provide an overview of the proposed rule, summarize the potential impact, and—in the spirit of Earth Day—outline how clients can share feedback with the SEC.

The Proposed Rule

SEC Chair Gary Gensler provided insight into the 500-page proposal at a briefing organized by Ceres last week. He referenced a report that showed 92% of S&P 500 and 70% of Russell 1000 companies publish sustainability reports[4], and added that 7,000 corporate annual reports reviewed by the SEC in 2019 and 2020 included some form of climate disclosure. “It makes sense to build on what so many companies are already doing,” he said during the briefing.

The proposed rule, which was published in March, would require public companies to disclose information related to their impact on the climate.

Required disclosures would include:

- Oversight and governance of climate-related risks, process for identifying, assessing, and managing and the degree to which these risks are integrated into the company’s risk management processes, targets, goals, and any transition plans

- How climate-related risks could impact the business over the short-, medium-, or long-term

- The potential effect of identified climate-related risks on the strategy, business model, and outlook

- Impact of climate-related events (i.e., severe weather events and other natural conditions) and transition activities on consolidated financial statements, related expenditures, and disclosure of estimates and assumptions related to these impacts

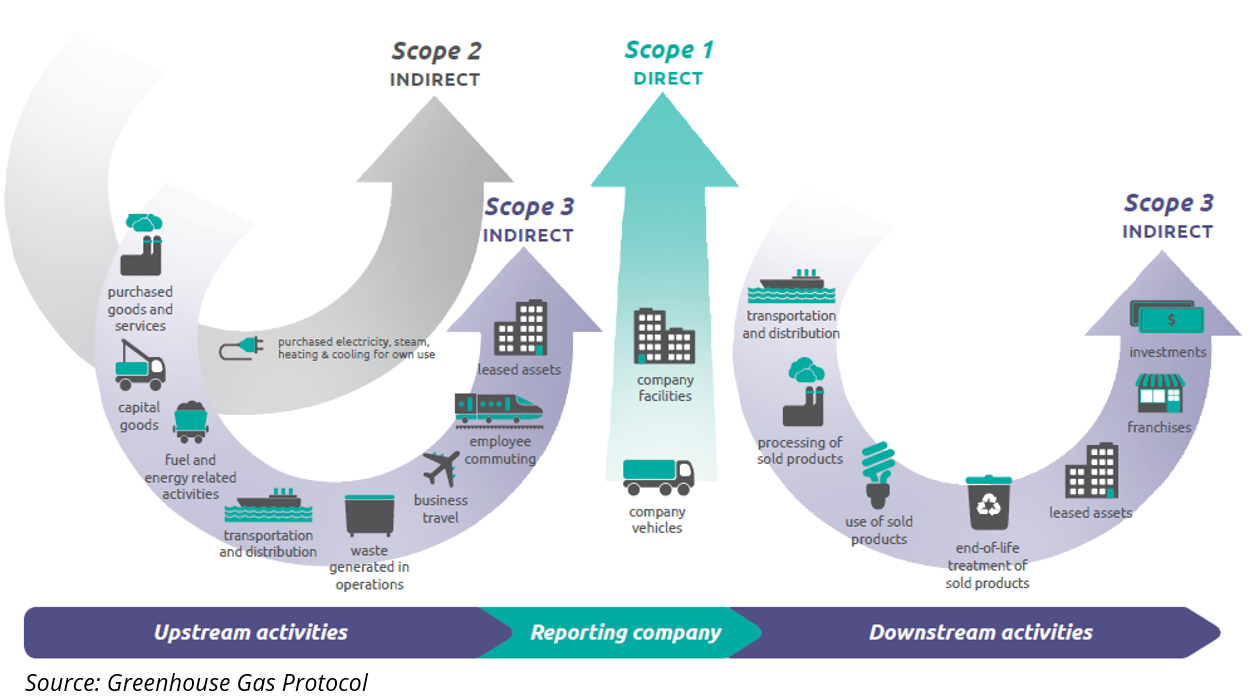

Additionally, the rule would require reporting of direct greenhouse gas emissions (“Scope 1”) and indirect emissions from purchased electricity or other forms of energy (“Scope 2”).Only companies with material “Scope 3” emissions and/or expressed targets for emissions from upstream and downstream activities in their value chains would be required to report on these emissions. Smaller companies would be exempt from Scope 3 disclosures.

Companies that do not include forward-looking statements—e.g., emissions targets, scenario analyses, carbon pricing, or transition plans—as part of their risk management would not be required to provide disclosures.

Gensler said the proposal is in line with the SEC’s mission to (i) protect investors; (ii) maintain fair, orderly, and efficient markets; and (iii) facilitate capital formation. He also referenced the Supreme Court’s definition of materiality, noting it is clear that there is a “substantial likelihood” that a reasonable shareholder would consider climate risk an important and material consideration.

“I believe the proposed rule would build on that long tradition,” he said. “It would provide investors with consistent, comparable, and decision-useful information for their investment decisions… and provide consistent and clear reporting obligations for issuers.”

Potential Impact

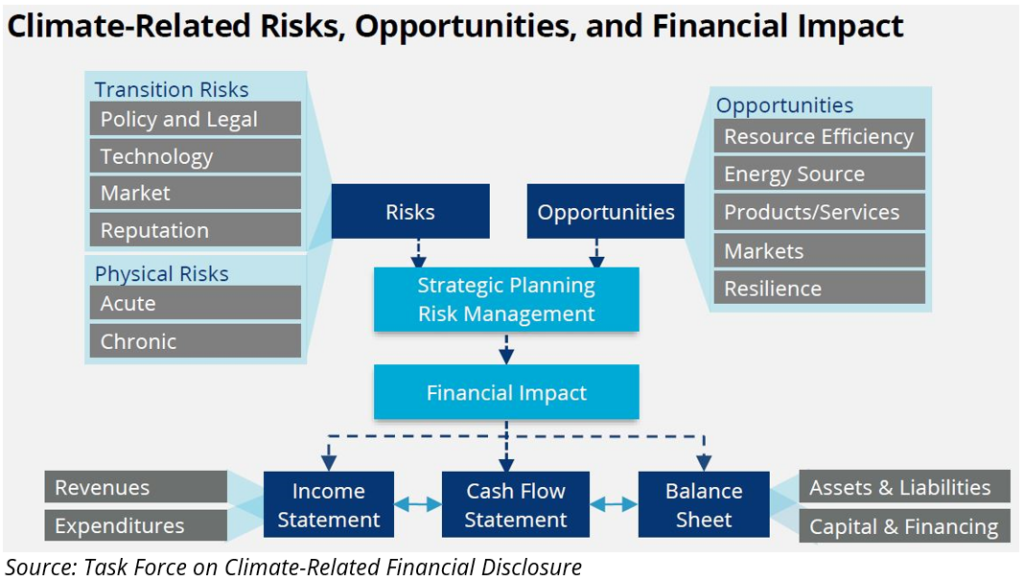

Climate disclosures by companies are already prevalent despite the lack of guidance from federal regulators. Thousands of U.S. companies already provide sustainability reports and climate-related information in accordance with Greenhouse Gas Protocol emissions methodologies and standards established by the Task Force on Climate-Related Financial Disclosure (TCFD).

The proposed rule incorporates many of the components of the TCFD and Greenhouse Gas Protocol frameworks and standards that have already been adopted by regulators in the European Union, Japan, the U.K., Switzerland, Brazil, New Zealand, Singapore, and Hong Kong. The U.K. was the first G20 country to mandate disclosures, which went into effect earlier this month, impacting more than 1,300 of its largest companies, banks, and insurers, as well as some large private companies.[5]

There is growing demand for such standards amongst companies, investors, investment managers, and the general public. At the COP26 UN Climate Conference last fall, 450 financial institutions representing $130 trillion in assets pledged to make climate change a priority in their work. A recent poll by Ceres found 87% of Americans support companies reporting climate-related risks.[6]

Outside of the environmental benefits, we believe investment managers—and therefore investors—stand to be impacted in a number of ways.

Potential Benefits

- A clear set of standards that would be universally applied and easily located/readily available.

- Data that was previously reported by companies would now be subject to third-party auditor verification as part of regulatory filings.

- Standardization of disclosures in all industries would give shareholders more leverage to force changes in business practices.

- Harmonizing standards with that of other countries would help measure progress, improve best practices, and compare companies.

- Incorporating standards in filings would lessen “survey fatigue” for investment managers and businesses collecting/providing relevant climate information independently.

- Companies opting not to set targets to avoid providing disclosures would likely receive pressure from activist shareholders to do so.

Potential Concerns

- Some companies may refrain from adopting any climate-related standards as a way to avoid reporting obligations.

- The rule would only apply to public companies, and more companies are choosing to remain private.

- Obtaining accurate data to satisfy Scope 3 emissions disclosure could be challenging.

- Scope 3 data will not be as consistent, and thus, comparable, as Scope 1 and Scope 2 data.

- The proposed phased-in nature of the disclosures is inconsistent with the urgency to act on climate change.

What You Can Do

Therefore, it should come as no surprise we strongly support the SEC’s rule proposal. While some modifications may be needed and are likely to occur as a result of the public comment process, we believe the rule is an important and much-needed step in the right direction.As an independent investment advisor, transparency is critical to what we do. Our role is to research on behalf of our clients by looking beyond brochures and factsheets to examine criteria we believe are critical to being an effective investment manager. Once fully adopted, the new rule will provide investment managers an unprecedented level of comprehensive, consistent detail on public companies that can be measured over time and used to make better investment decisions.

We encourage clients to review the proposed rule and submit comments to the SEC. Please see the links to the right to learn more about the rule and how to submit comments directly to the SEC (public comment period ends May 20)—and don’t hesitate to reach out with any questions.

Finally, on this Earth Day, we remember the words of environmental trailblazer Rachel Carson, who spent much of her life along the Maine coast, not far from our Portsmouth, NH headquarters. In her landmark book, Silent Spring, she wrote:

“The balance of nature is not a status quo; it is fluid, ever shifting, in a constant state of adjustment.”

In her writings, Carson made clear she felt humans were part of this balance. While we are certain Carson did not think of “balance” in a financial sense, experiencing the ebbs and flows of the markets over the past 30+ years has made us all too familiar with the need to react to constant state of adjustments. It has become increasingly clear that the careful balance between the role of investors as stewards of capital and stewards of the Earth is more critical with each passing year. While there remains much to be done, we are encouraged by this moment.

Take Action

Click here to submit comment to the SEC

[1] Earth Day Network (earthday.org)

[2] The Lancet Planetary Health (thelancet.com)

[3] Munich RE (munichre.com)

[4] G&A Institute (ga-institute.com)