Education, Perspectives

Prime Buchholz ESG & DEI Surveys: Understanding Integration Across Recommended Managers

Jan 26, 2022

Back to all postsIntroduction

Since one of our first clients sought to stand against Apartheid and divest from South Africa in 1988, Prime Buchholz has been helping clients reflect their missions and values through their investment portfolios. With a client base rooted in philanthropy, we have witnessed interest in mission-aligned investing build exponentially, particularly in the last decade.

Summer 2021 marked the sixth annual survey of Prime Buchholz’s recommended managers on their environmental, social, and governance (ESG) policies and practices—both at the firm and strategy level. The information collected provides invaluable insight into the investment managers we recommend to clients. Of the 300+ firms surveyed (representing 800+ investment products), more than 80% responded to our questions.

The rapid growth in mission-aligned investing has necessitated our survey evolve as our clients’ needs have evolved. In response to concerns regarding diversity in the investment industry, we began requesting detail and statistics regarding diversity, equity, and inclusion (DEI) policies in 2018.

The following report is intended to share our survey process and overall results, as well as implementation strategies. Individual manager responses and scores for client portfolios are available in quarterly reports and our online portal, PrimePlusSM.

ESG

Since our 2018 survey, investment managers—and later individual investment products—have been scored based on the manager’s reported ESG integration at the firm and strategy level, as well as their reported engagement with underlying investments, sustainability organizations, and partnerships. We also request managers answer questions seeking qualitative information on their ESG policies, practices, and initiatives.

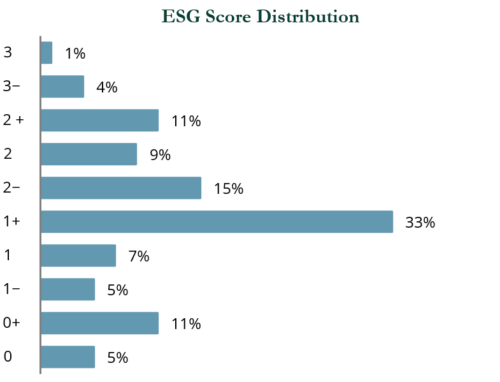

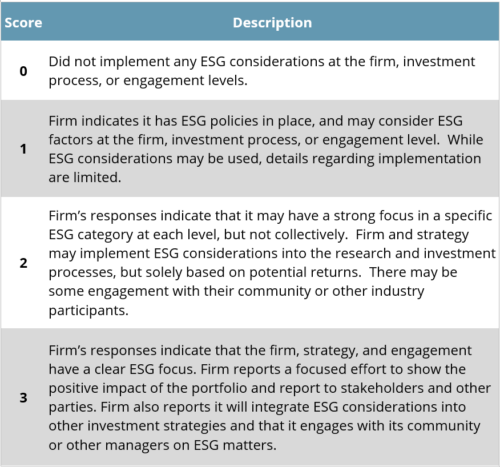

We score each investment product based on the firm’s responses, with each individual ESG subcategory—environmental, social, and governance—representing one point. These average scores are then combined to create a total combined score, which ranges from 0 to 3. The scoring distribution for our recommended managers in the 2021 survey and details on the scoring decisions follows.

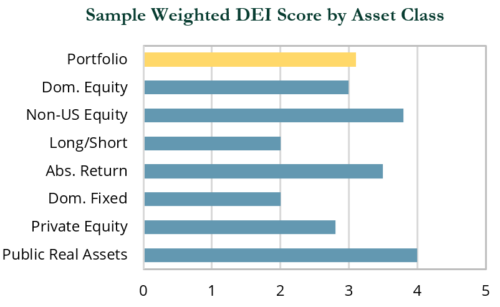

Results by Asset Class/Style

- Non-U.S. equity managers had the highest average score at 1.73.

- Long/short flexible capital managers had the lowest average score at 0.59.

- Managers with average scores (1.0–1.5) typically reported ESG policies, but may not have fully integrated ESG at the firm, strategy, or engagement level.

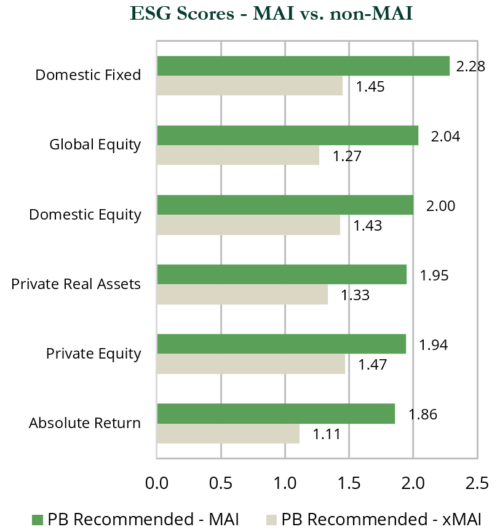

With approximately 200 products on our MAI recommended list, there are a variety of managers and strategies available to clients seeking to improve ESG scores—across all asset classes.

DEI

Managers are asked to provide detail on firm demographics, including the percentage of women and underrepresented groups in their ownership, senior management, investment teams, and organizations. In 2021, we began to use this information—along with qualitative information reported by the manager such as diversity and inclusivity policies and initiatives—to score each firm on a five-point scale.

As with the ESG survey, each DEI score is accompanied by information provided by the firm on DEI policies, practices, and initiatives, which are designed to help clients understand how each of their managers is promoting DEI at their firms and in the industry. We plan to track this data year-over-year to map progress in the information reported by our universe of recommended investment managers.

It is important to consider that DEI can be a complicated and nuanced topic that is difficult to fully capture on a five-point scale. Further, many European firms are prohibited from collecting this kind of employee data, while other non-European firms choose not citing privacy concerns. In these instances, the survey provides firms with the opportunity to share why they are unable or unwilling to disclose (publicly owned, regulatory reasons, or not tracked). We believe the qualitative feedback is a vital part of the process, even if the detail provided is inconsistent or the assessment of the information is challenging.

Results

Numerous studies have concluded that diversity in the workplace can have positive effects on team dynamics and performance. However, the investment industry has been slow to address a history of gender, racial, and ethnic homogeneity. A 2020 report by the Knight Foundation and Bella Private Markets showed women and/or minority-owned firms represent approximately 1% of the $82+ trillion asset management industry—despite similar performance results.

Scoring

Investment managers received a score on a five-point scale. One point was awarded for ownership diversity of 20% or more at the firm, management, and total organization level, with a half point awarded for diversity of 1–19%. Additional points were awarded when firms cited one or more internal DEI initiatives and/or one or more DEI partnerships or outreach programs. It is important to note that the thresholds for what constitutes a diverse firm vary considerably in the investment industry; we plan to evaluate our own definition in future scoring.

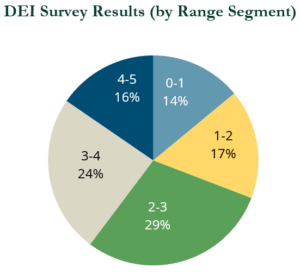

Scores were broadly distributed among the managers who responded, with a middle score of 2-3 representing the biggest segment (29%). It is encouraging that the number of managers falling in the highest scoring segment surpassed those in the lower segment.

Portfolio Implementation

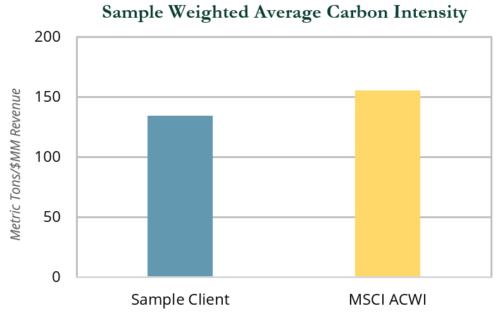

The acceleration of interest in ESG and DEI investing has sparked rapid growth in the number of strategies, managers, and investment products available to investors. The industry’s ability and willingness as a whole to respond to investor demand in a positive, meaningful way is a welcomed development. We are proud of the quality and depth of the ESG and diverse options available on our recommended manager list and excited to see more clients implement these strategies each quarter.

However, the influx of options has required more stringent evaluation of the intent, abilities, and adherence of investment managers to their stated policies. The intentional misrepresentation of sustainable practices (a.k.a., greenwashing) is a formidable challenge for the investment industry and its participants.

We reevaluate our ESG and DEI survey each year in an effort to improve the quality of information provided to clients. Our analytics are available in quarterly reports and our online portal, PrimePlusSM, and can help clients assess exposures and monitor progress toward specific goals. The commentaries and scoring may also be included in manager searches to support the inclusion of these factors in decision-making.

If you are a client interested in receiving this analysis, please do not hesitate to reach out to your client service team.

If you would like to learn more about our core offerings and how we can serve your organization, please fill out the form below and click “submit.”